In 2025, global equity markets could face an environment characterized by several crosscurrents. Global investors expect next year to witness a higher dispersion across stocks, styles, sectors, countries and themes. This shall provide a better backdrop for active investors after consecutive quarters of broader market appreciation.

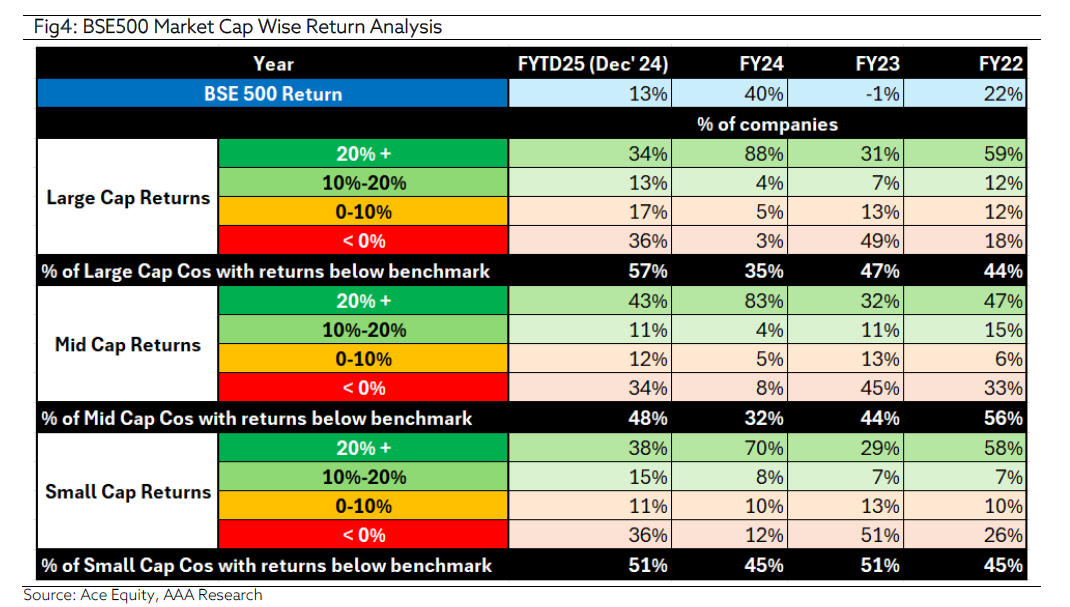

We enter 2025 optimistic yet balanced in our outlook, cognizant that two years of good gains and a broadening market suggests a lot of good news is priced into a growing number of stocks. After seeing a 21% CAGR by BSE500 Index over the past two years, we do see a possibility for index returns to normalize towards the annual average. However, one should not judge market returns by indices, as we see enough opportunities across individual companies to maintain a constructive, risk-on stance. We believe 2025 is going to be a stock-picker’s year, as winners and losers would emerge across sectors. We reemphasise on our view that what you don’t own will be as important as what you do.

A changing balance of risks

India continues to remain the highest GDP growth amongst large economies, though corporate EPS growth expectations have been toned down. The global economy appears to have reached a balance. Moderate growth, disinflation and continued monetary easing could all bode well for the global markets.

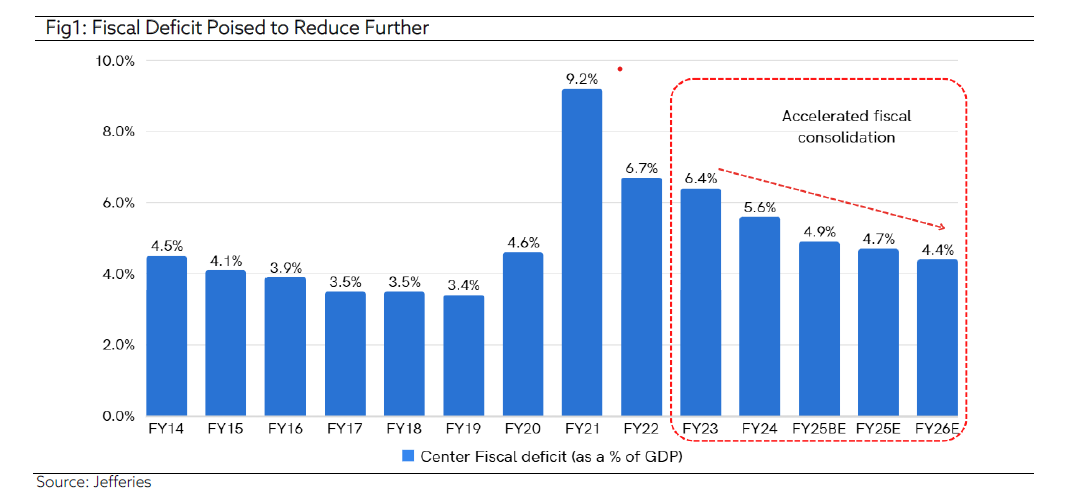

Importantly, India’s fiscal prudence lays a solid foundation for future economic growth, with the fiscal deficit coming down from 9.2% in FY21 to 5.6% in FY24, as seen in figure 1. Notably, S&P has upgraded India’s rating outlook from stable to positive in May 2024. Furthermore, S&P has indicated that a fiscal deficit below 7% of GDP on consolidated (centre + state) basis will be a trigger for rating upgrade to BBB (from BBB-). With the state fiscal deficit at ~3%, centre’s fiscal deficit consolidation towards 4.0% is needed for the upgrade.

With that being said, the American tariff policy remains a key question mark, although we believe that direct impact of Trump’s policy’s impact on India appears to be limited given the low goods manufacturing & exports base, as compared to other Emerging Markets. India’s exports into the US are mostly services, which have been spared actions so far.

Capex to continue

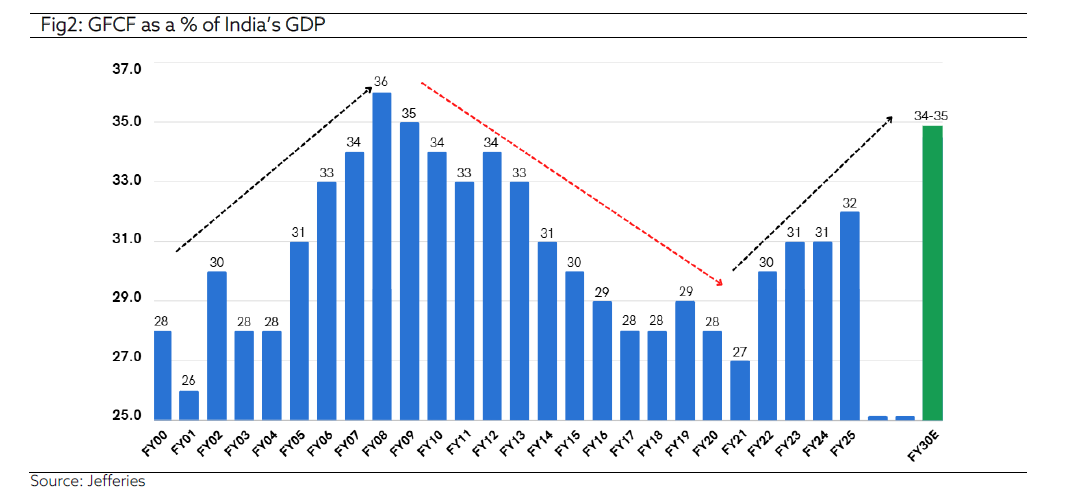

India remains in the middle of a capex upcycle, and although the slowdown in government capex in mid-2024 has created worries about the sustainability of the upcycle, we believe it is transitory and 2025 shall probably see more robust capex indicators. The two largest segments – housing and corporate capex – which contribute 75% to total capex, are doing well and even as the government capex surge slows down, overall capex to GDP ratio is still expected to rise over the next four to five years. Multiyear housing cycle upturn is still ahead of us. For the corporate segment, bank data indicates a surge in corporate spending approvals, and we believe power / electrification, PLI schemes etc. would be the anchors. India’s efforts to attract FDI is also paying rich dividends, for instance, over the last 18 months, India has seen 20 billion dollars’ worth of investments announced across five semiconductor facilities – which are in turn triggering significant supply chain investments. In Housing, new pre-sales have risen by 50%+ over the past three years and same is now translating to housing construction spurt bodes well for a long supply chain of building materials, electricals, cement, tile cos, etc.

The spending by corporates on creation of new capacities is also seeing a surge. Private capex approved by banks jumped 60% YoY in FY24, as per RBI data, which demonstrates a large investment intention in the years ahead.

Rural Revival?

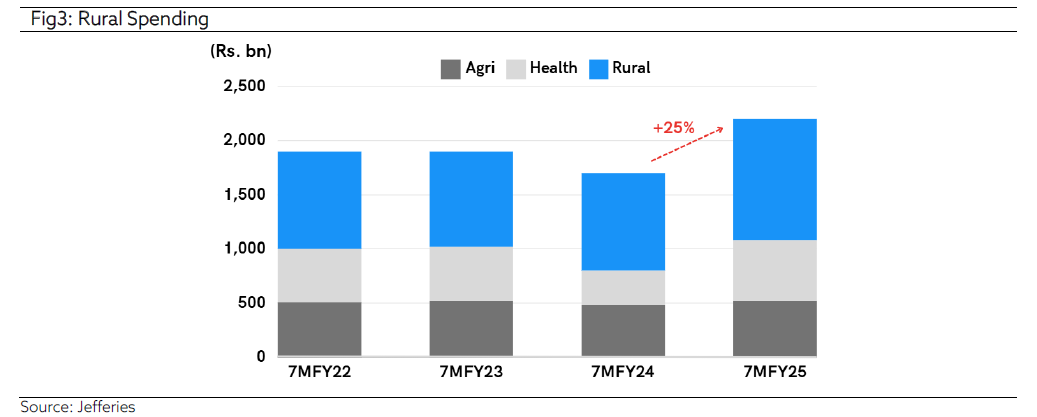

Above normal monsoon, healthy water reservoir levels and an increase in government spending in the rural space is poised to revive the rural macros. This implies a sentimental positive for consumption at the lower income / rural economy segments. We believe penetration to continue in staples, and given the changing trends and demographics, we believe discretionary categories are in a good position to benefit from a change in the aspiration levels. Early signs of a rural revival is possible as evident from the figure below, indicating a 25% increase in rural spending for the first seven months of 2025.

Being Selective

As we had outlined in our previous AAA Insights, we continue to believe that active stock-picking shall be instrumental for sustained alpha generation. As seen in the table below, the number of companies with returns more than 20% have reduced across all market cap categories. Furthermore, the number of companies with returns below benchmark has seen a stark increase as compared to last year. This symbolizes the need to increasingly focus on what to own and what not to own.

Quarterly Update

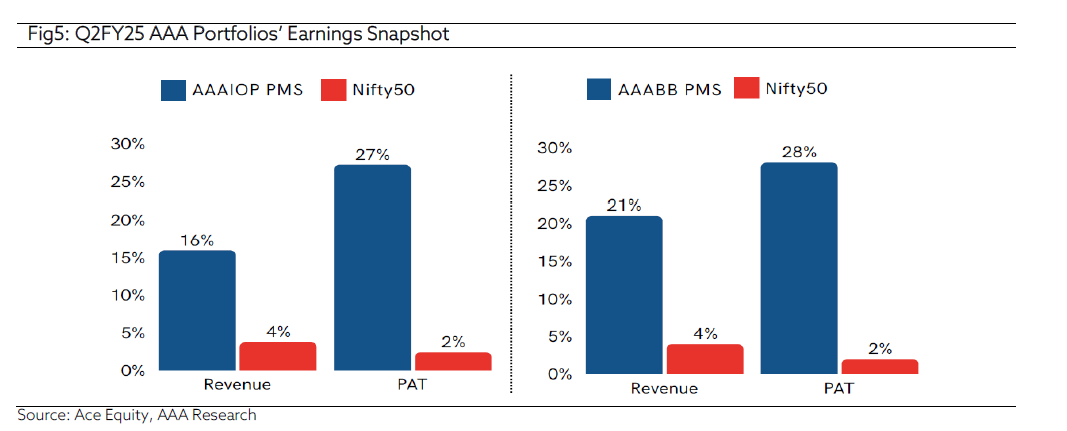

After witnessing a relatively weak first quarter, Nifty reported another muted quarter with revenue growth of 4% and net profit growth of 2% in Q2FY25. Against this backdrop, AAA portfolio companies delivered a solid quarter, both in revenue as well as profit terms, as seen in the figure below.

Bottomline

Stay invested but maintain a risk-aware approach. When faced with market gyrations or geopolitical uncertainty, the biggest mistake investors can make is to retreat to the sidelines. The opposite is also true. Do not rush in at market peaks. Successful investing is a long-term endeavour. Focus on your goals and don’t let the daily noise distract you.

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

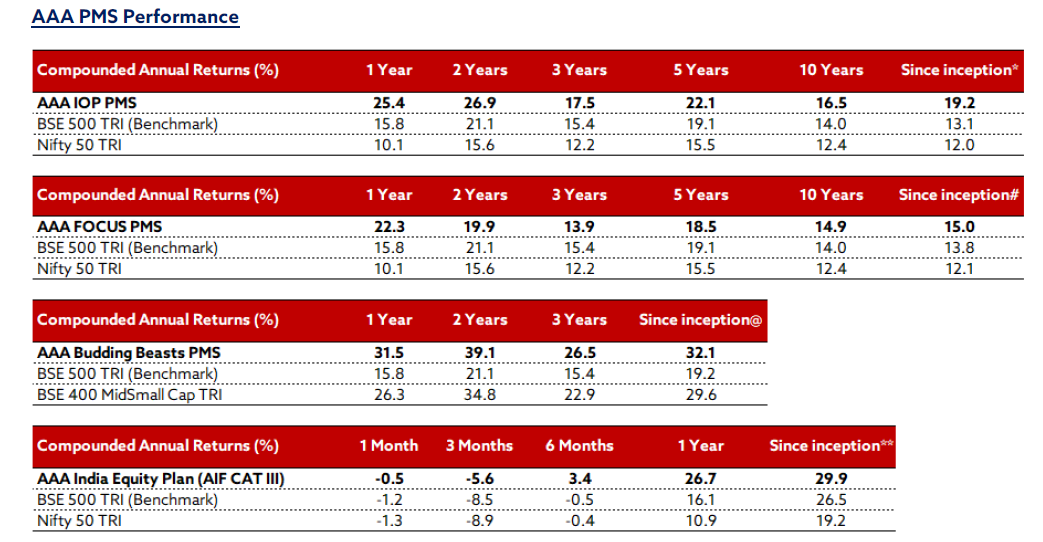

*(23 Nov 2009 – 31 Dec 2024); #(17 Nov 2014 – 31 Dec 2024); @(01 Jan 2021 – 31 Dec 2024); **(16th May 2023 – 27th Dec 2024)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.