Times are tricky. Some tend to find solace in the Nifty50’s ~7% year to date rally, while others see the recent spike as a sign to become cautious. The global narrative is constantly evolving, with the Fed not forecasting a US recession anymore, which has resulted in mixed market sentiments on Wall Street. The recent uptick in the Indian markets has resulted in investor apprehension with regard to the nature of the rally. In order to understand the sustainability of this recent market appreciation, we have made an attempt to assess its underlying strength below.

Improving Market Cap Breadth

One important indicator which we use to gauge the sustainability of a significant index appreciation is the breadth of participation in terms of the number of companies. During the Jan-Jul period, the Indian equity markets witnessed a widespread contribution from companies of all sizes and sectors. The top 10 stocks in the BSE500, which account for 52% of the index, exhibited a median increase of just 9.8% from January to July. Interestingly, the remaining 48% ran the show, by exhibiting a solid median increase of 14.1%. A similar trend is visible in Nifty constituents as well, as the Nifty50 equal weight index has performed better than the Nifty50 market cap weighted index. On the earnings front, in FY23, 42% of BSE500 companies delivered robust earnings growth of more than 20%, almost double the Nifty50 earnings growth of 11.5%. This is a positive sign as it reaffirms the strength of the market, and symbolizes a resilient economic backdrop.

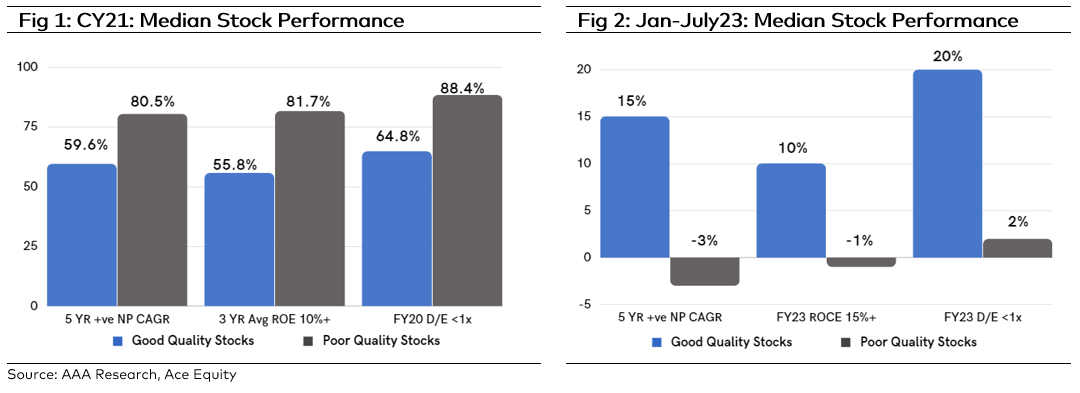

Quality – Affirmative

We define a company as good quality, if it has a positive Net Profit CAGR over the past 5 years, a low D/E ratio, combined with a reasonably good Return on Capital Employed (ROCE). On the contrary, a poor-quality company would have a negative 5-year Net Profit CAGR, a relatively higher D/E, and low ROCE. Just 2 years ago, in 2021, we witnessed a massive bull market, led by the recovery from the pandemic and excess global liquidity. At that time, the poor quality stocks were the primary driver of the bull run (Refer Fig 1), thereby resulting in a quality paradox, which we had covered in our July 2021 newsletter. However, this time is different as good quality companies with solid fundamentals are powering the current rally (Refer Fig 2), which poses the question – Is this the start of a new structural bull market? Well, the markets seem to have climbed the wall of worry, and although volatility may persist, the numbers seem to narrate a good story for the coming years.

Market Outlook

As mentioned above, based on the underlying fundamentals, we are fairly optimistic about the Indian equity markets in the long term. Short-term may be filled with ebbs and flows, but we see opportunities. The fears of an inadequate monsoon season – impacting consumer sentiments – seem to have subsided as the South-West (SW) Monsoon in India has progressed well across the country. On a cumulative basis, rainfall this season is 5% above long-term averages with ~80% of India’s geographical areas experiencing normal or excess rainfall. Current rural macros – declining rural inflation, improving real rural wages, healthy central government rural spending, above average Kharif MSP increase, and strong agriculture GDP growth – are showing positive signs of a rural recovery which may further get better, if there’s another year of normal monsoon. While the B2B sector is already seeing strong tailwinds, B2C could also start contributing to the earnings growth of Corporate India. We continue to remain QuAgile, seeking out the best businesses with high growth prospects at the right valuations. Globally, the economic outlook is tilting towards the positive side, which indicates the possibility of a more stable market going forward. Quality remains a paramount factor in our stock-picking process, thereby insulating us from significant downside during market dislocations while enabling us to benefit during rallies.

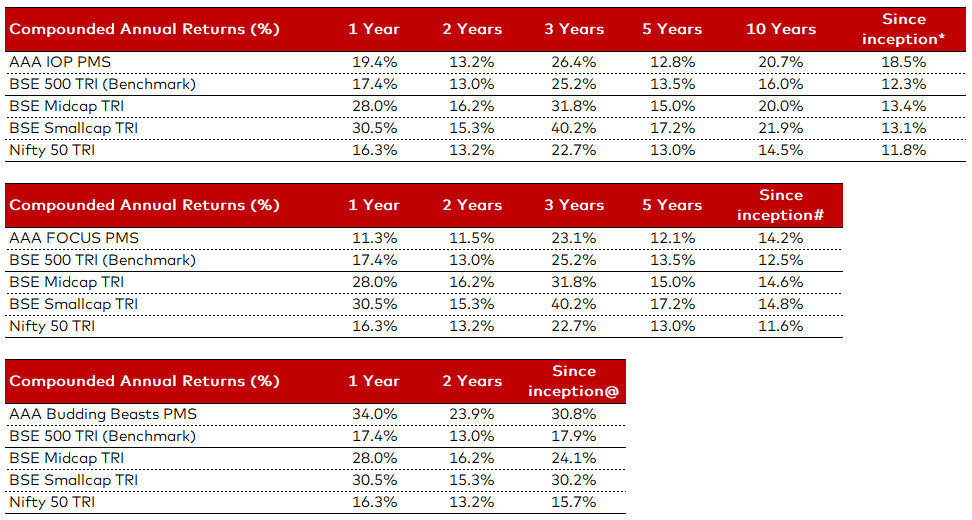

AAA PMS Performance