Markets can go up, down, or sideways. Keeping your calm during such moves is imperative for long-term wealth creation. Dancing to the market tunes, be it bullish or bearish, may not be the optimal, as sometimes emotions can take over rationality. We believe it is more imperative to assess the health of your portfolio, and ensure that they adhere to certain quality parameters. In short, it may be prudent to be selective.

Israel-Iran Situation

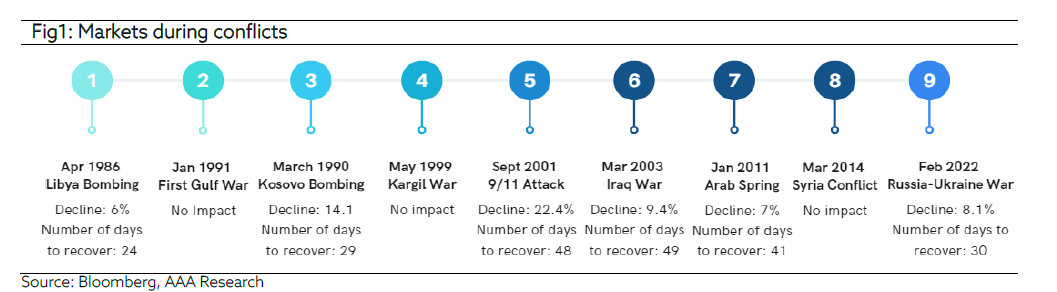

When there’s uncertainty, the best thing to do is remember that staying invested in a quality portfolio has paid off through countless geopolitical crises, wars, pandemics, supply chain interruptions, labour strikes and recessions—and will likely continue to do so. As evident from the figure below, being patient and staying put in quality names has almost always been rewarding in the long-term, as markets seem to have recovered within a fairly short amount of time (average = 24 days) quite a few times.

Today, our investment approach tries to recognize the world’s inherent uncertainties and fragilities. Our investment view is not predicated on declining global conflict. All in all, the markets seem to be aware of the conflict in the Middle East. Asset classes that are the most sensitive to geopolitical risk have moved in-line with our expectations. Oil has spiked by about 13% over the past month, while gold has remained near all-time highs.

When it comes to oil, excess supply along with subdued demand should help keep the price gains contained. All of this is subject to change if we do see material escalation, but our understanding of how broader markets have behaved around similar geopolitical events suggests that the economic backdrop and business cycle are the key dynamics to watch.

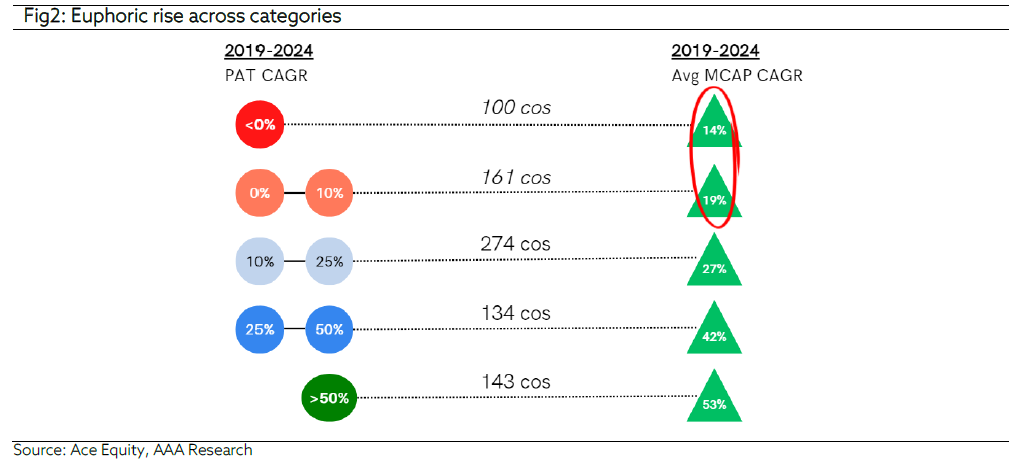

The last five years have been exciting, with the Indian equity markets being generous as the Nifty multiplied by more than two-fold and the small and mid-caps expanded four-fold. In such bull markets, we often see cases where investors forget that shares of a company represent an ownership interest in an underlying business and instead treat them as digital lottery tickets seeking to capture the latest market rally or trend. As a result, they overlook a company’s fundamentals and behave like speculators, buying shares with the hope that someone else will pay a higher price down the road. If one looks at the numbers, there were 261 companies where earnings growth was modest at best (<10% CAGR FY19 – FY24), and still compounded by 14% on average over the past five years as seen in figure 2 above.

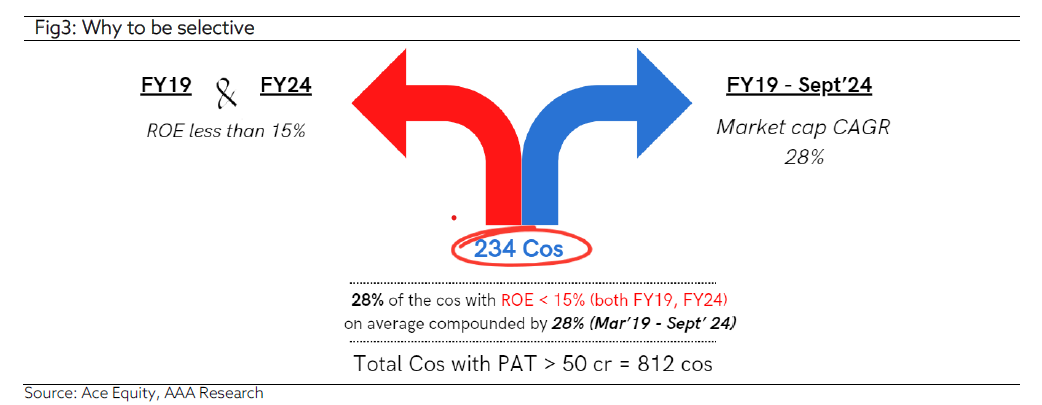

On a similar note, as on 31st March 2024, there were 234 companies which had a ROE of less than 15% in both FY19 and FY24, yet compounded by 28% on average over the past five years as seen in figure 3.

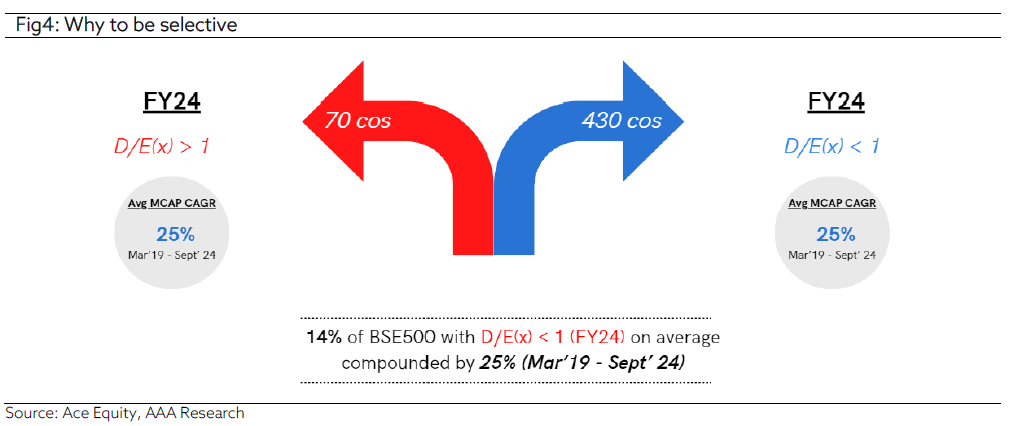

Taking a step further, upon looking at the leverage levels of BSE500, it is astonishing to see that quality stocks haven’t enjoyed any premium as such, since both overleveraged and debt-free companies have compounded by 25% on average from FY19 to FY24. Thus, markets have so far not distinguished between high quality stocks and poor-quality stocks.

During the start of this year, we had outlined the importance of being prudent in our Feb 2024 newsletter. We mentioned how such trends are not sustainable and were of the view that markets would eventually differentiate between high quality stocks and poor-quality stocks. Low earnings growth and high valuations is a classic indicator of an eventual correction. We re-emphasise our strategy of remaining focused on quality businesses.

The global macro environment has made investors nervous during the last few weeks. The recent Fed commentary indicates the possibility that the monetary policy fight to tame inflation may be long-drawn, contrary to market expectations, with equity markets gradually reconciling to the ‘higher-for-longer’ view. In such a volatile and uncertain environment, the divergence between winners and losers becomes stark, and hence, we believe that the bottom-up approach is more rewarding for investors. Moreover, multiple changes are happening simultaneously at an unprecedented pace – government policies, decarbonisation, technology trends, consumer preferences, etc. Such dynamic changes offer a new window of opportunities for the companies and, at the same time, have the potential to make existing businesses redundant. As your investment manager, our job is to identify businesses that can exploit new opportunities, i.e., “winners” and at the same time, avoid businesses that may look great but have a danger of falling into the slow growth lane, i.e., “losers”.

Quarterly Update

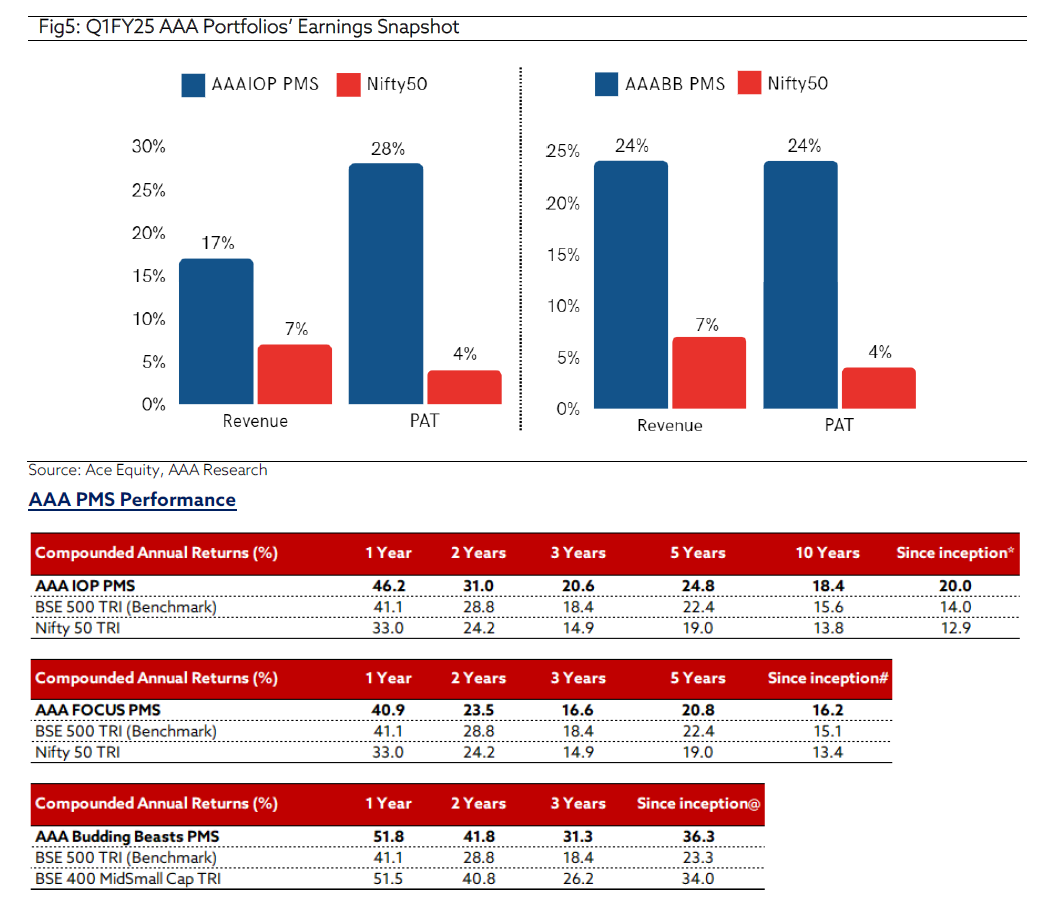

After witnessing strong growth during the last three years, Nifty reported a muted revenue growth of 7% and net profit growth of 4% in Q1FY25. Oil and metal were major draggers. Excluding these two sectors, the net profit growth was reasonable at 13%. Against this backdrop, AAA portfolio companies delivered a solid quarter, both in revenue as well as profit terms, as seen in the figure below.

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

*(23 Nov 2009 – 30 Sept 2024); #(17 Nov 2014 – 30 Sept 2024); @(01 Jan 2021 – 30 Sept 2024)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.