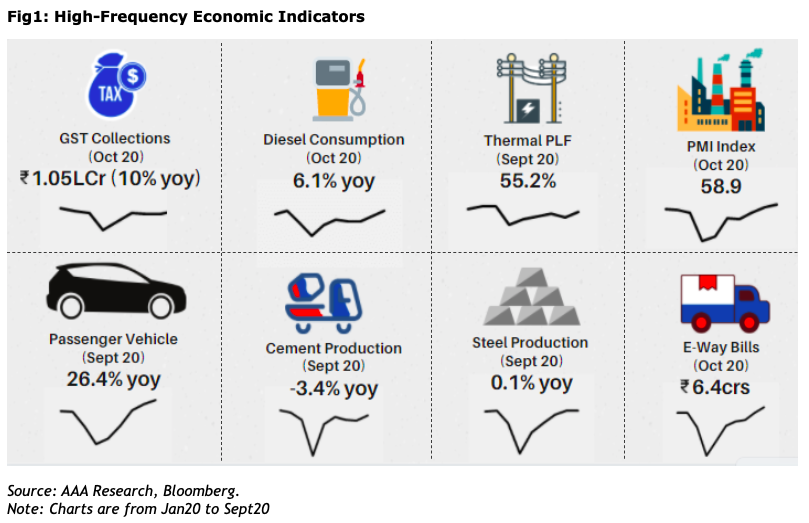

Indian economy surprised positively contrary to extreme pessimism during the early days of Covid-19. The economy witnessed significant improvement in high-frequency data indicators like GST collection, diesel consumption, power consumption, e-way bills registered positive yoy growth in Oct20. While it is difficult to gauge the extent of pent-up demand, we understand that economy is coming back to normalcy. Normal monsoon helped Rural India to remain strong compared to urban India which got impacted severely due to lockdowns. RBI and the government also took several steps to improve the liquidity in the system.

2QFY21: A big positive surprise

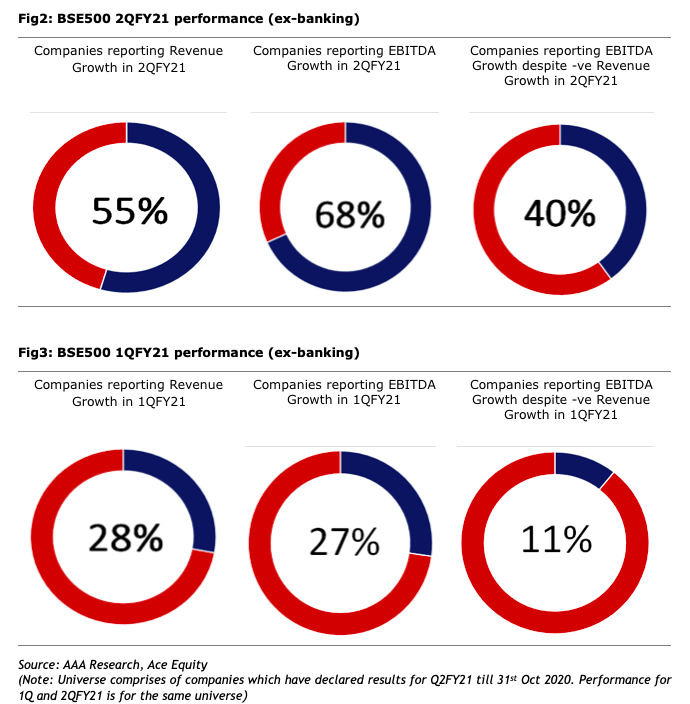

In Q2FY21, nearly 154 non-bank companies (m-cap weightage 47%) in BSE 500 index reported results till Oct end. Despite the challenging business conditions, 55% of this universe reported revenue growth and 68% reported EBITDA growth for Q2FY21 quarter (Fig2). The sharp focus on cost resulted in many corporate reporting positive EBITDA growth despite de-growth in revenue (40% of this universe) – contrary to the general belief that de-growth in revenue means disproportionate de-growth in EBITDA. On qoq (sequential basis), the improvement was significant as can be seen in Fig3.

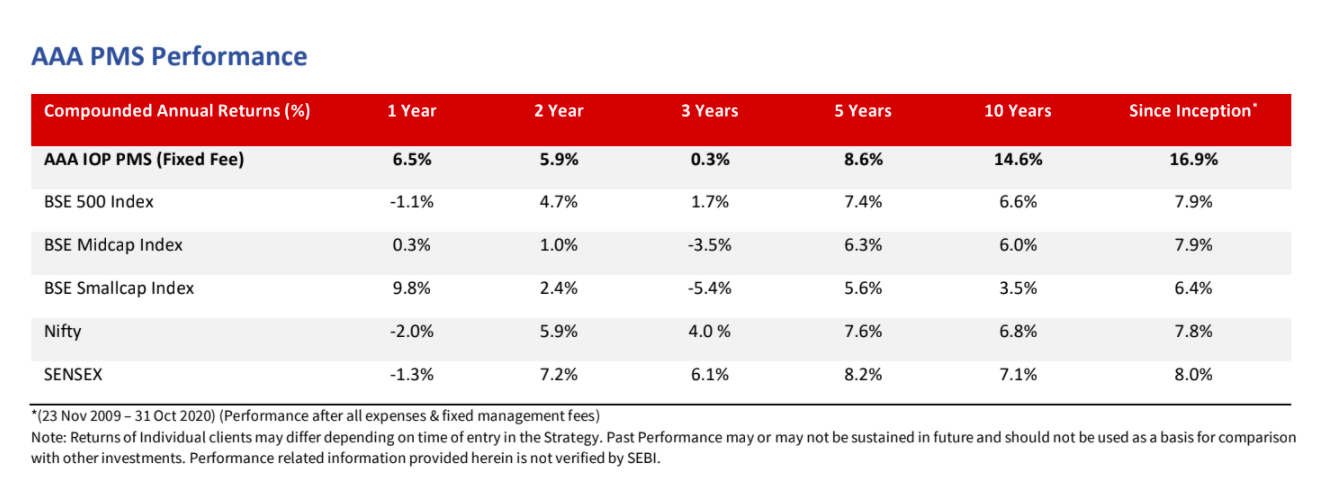

AAAPMS Score Card

AAAPMS portfolio companies demonstrated leadership, agility, and resilience during the pandemic crisis. Innovative ways to reach consumer helped them to gain market share. Rigorous cost control enabled them to deliver improvement in profitability. Zero/low leverage – the hallmark of resilience allowed them to strengthen their competitive edge.

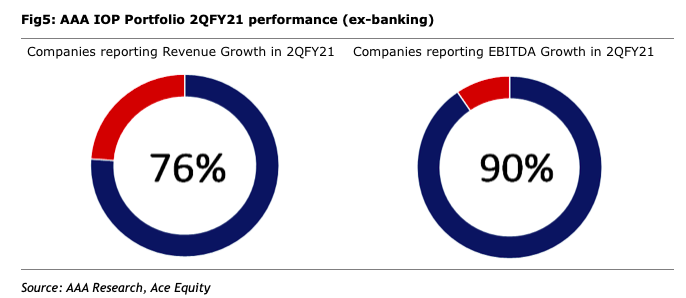

In our portfolio, nearly 40% of companies (by weight ex-banking) reported Q2FY21 results. 76% of this universe reported positive revenue growth and 90% of this universe reported positive operating profit growth (Fig5)– significantly better than 55% and 68% for the broader universe, respectively. Our banking holdings also did exceedingly well both in terms of growth as well as asset quality.

Market outlook

Barring a substantial market shock and implementation of broad-based lockdowns amid accelerating Covid-19 cases in the winter months — not our central case scenario — the economy will continue to grow steadily in 2021. US election outcome is round the corner that may add volatility to the market. We continue to remain focused on what we believe to be high quality companies that benefit from long-term trends, are well positioned in their respective market, have a strong business model that generates cash, and are run by a superior management team. We believe these features are essential to generating long-term returns and serve as protection when circumstances change.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd. nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.