In our December 2020, AAA Insights, titled “2021: Embrace Optimism”, we had mentioned that the Indian economy is poised for faster growth as

1) the pain of structural reforms is behind us

2) Indian government’s efforts to revive the Indian manufacturing sector through various initiatives like PLI scheme are impressive

3) Faster formalisation & digitization of the economy and

4) a more robust banking system further accelerates the pace of normalization.

To this end, we observe that Union Budget 2021 has shown the government’s strenuous efforts to stay the course in each area.

Focus on spending to accelerate growth

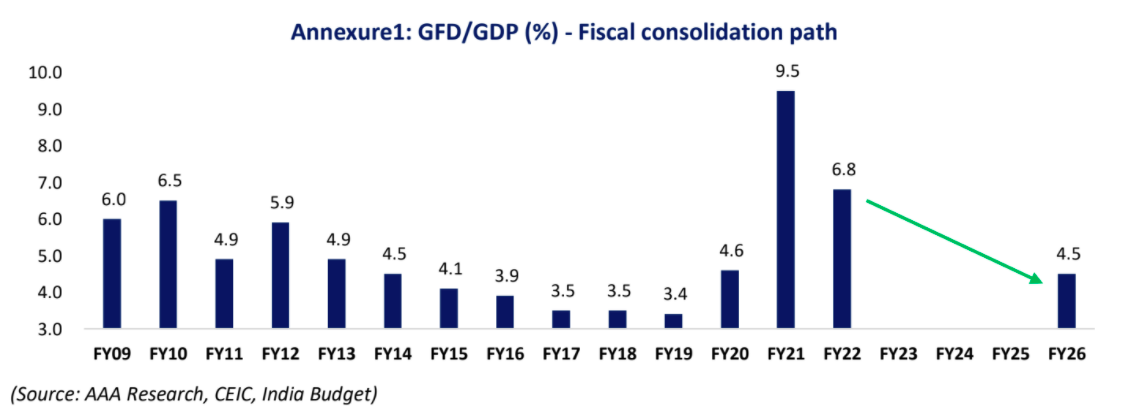

The government has relaxed its FRBM commitments, as it aims to reach a fiscal deficit 4.5% of GDP by FY2026 – this is a significant step as the government was always walking the fiscal prudence path till last year. As the major world economies have been on a spending spree, Indian government has rightly used the budget as an opportunity to push the spending accelerator. Govt has planned to utilise the additional fiscal space for capital expenditure as it has budgeted a 13% increase in capital expenditure (Direct+IEBR) to Rs11.4 tn for FY22. These measures will provide crucial support for faster economic growth.

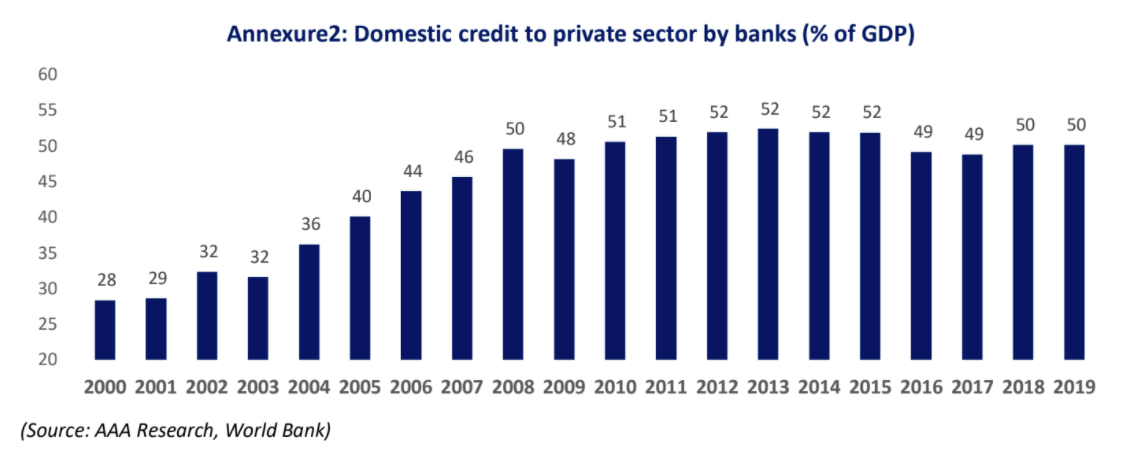

Bad bank to revive growth

The government has relaxed its FRBM commitments, as it aims to reach a fiscal deficit of 4.5% of GDP by FY2026 – this is a significant step as the government was always walking the fiscal prudence path till last year. As the major world economies have been on a spending spree, the Indian government has rightly used the budget as an opportunity to push the spending accelerator. Govt has planned to utilise the additional fiscal space for capital expenditure as it has budgeted a 13% increase in capital expenditure (Direct+IEBR) to Rs11.4 tn for FY22. These measures will provide crucial support for faster economic growth.

PLI Incentives: A Sharp Turn in India’s Investment Policy

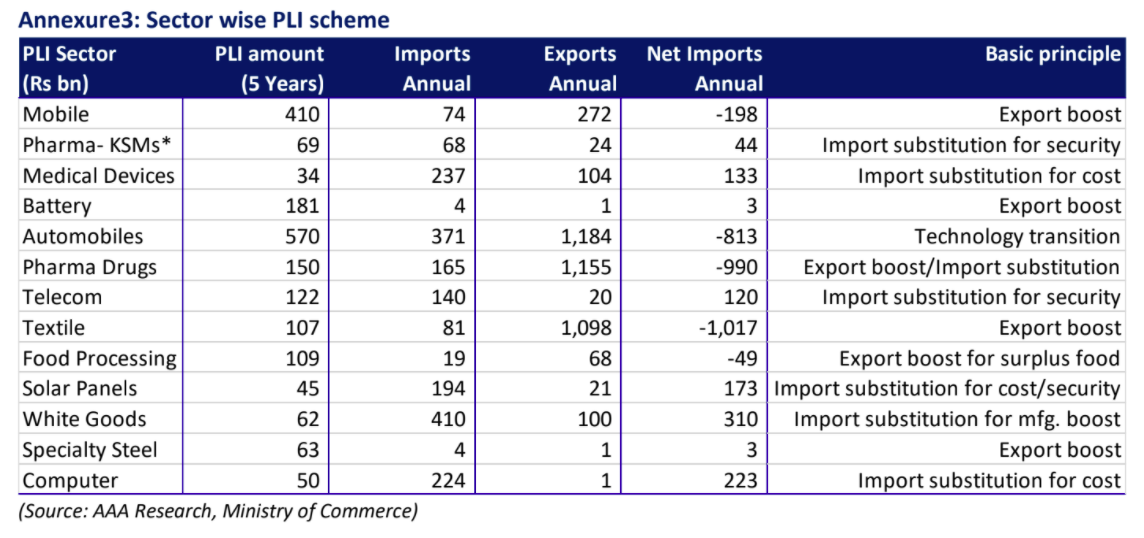

Production-Linked Incentives (PLI) scheme is a potential game-changer for the Indian manufacturing sector. The PLI scheme will lead to the following: 1) reduce India’s import dependence for critical components, 2) strengthen cost competitiveness in the global supply chain and 3) encourage global players to set up large scale manufacturing in India.

The Government will provide Rs2tn of incentives over 5 years for 13 sectors – 8.6% of India’s Manufacturing GDP (Refer Annexure3). To illustrate, through the Mobile PLI scheme, from the current value addition of 10-15%, the government hopes that domestic value addition reaches 35-40% by FY27. The PLI Schemes can generate US$144bn in incremental sales by FY27 i.e. ~1.7% of FY27 GDP.

DFI for Infrastructure

With an aim to improve the funding for the country's infrastructure sector, the Union Budget has allocated Rs 20,000 crore for the Development Financial Institution (DFI), with an ambition for the lender to have a portfolio of Rs 5 lakh crore within three years. This initiative will go a long way as DFI will act as a provider, enabler, and catalyst for long term infrastructure financing.

Asset Monetisation (Divestment & Strategic Sale)

Resisting the temptation to hike taxes, the finance minister banked on disinvestment and asset monetisation to increase the government’s revenue. A national monetisation pipeline will be launched, with a dashboard to track the progress and provide visibility to investors. The government plans to monetise operating public infrastructure assets in areas like road, transmission line, freight corridor, airports, Central Warehousing Corp, and sports stadiums.

The government has approved the proposed policy for disinvestment in all non-strategic and strategic sectors. BPCL, Air India, Shipping Corp, Container Corp and other disinvestments are aimed to be completed in 2021-22. The Budget proposes taking up 2 PSU banks and one public sector insurance company for disinvestment. The government is also targeting to bring the LIC IPO in 2022. This should help the government to fund the ambitious capex plan without putting the additional burden on the taxpayers.

Our Investment Strategy / Market Outlook:

3QFY21 corporate earnings are turning out to be a positive surprise – 27 Nifty companies reported 30% earnings growth in 3QFY21 while 178 BSE500 index companies reported 47% earnings growth (yoy basis).

The growth-centric budget further raises our confidence in the growth prospects for the year ahead. We believe that with strong earnings growth and continued government efforts to revive the Indian manufacturing sector, the market has a long runway ahead. We remain positive on market and recommend investors to use correction as an opportunity to add to the equity asset class.

Key risks: Effectiveness of the covid19 vaccine, reduced policy support by global governments and central bankers, rising commodity prices leading to higher inflation, and geopolitical shocks.