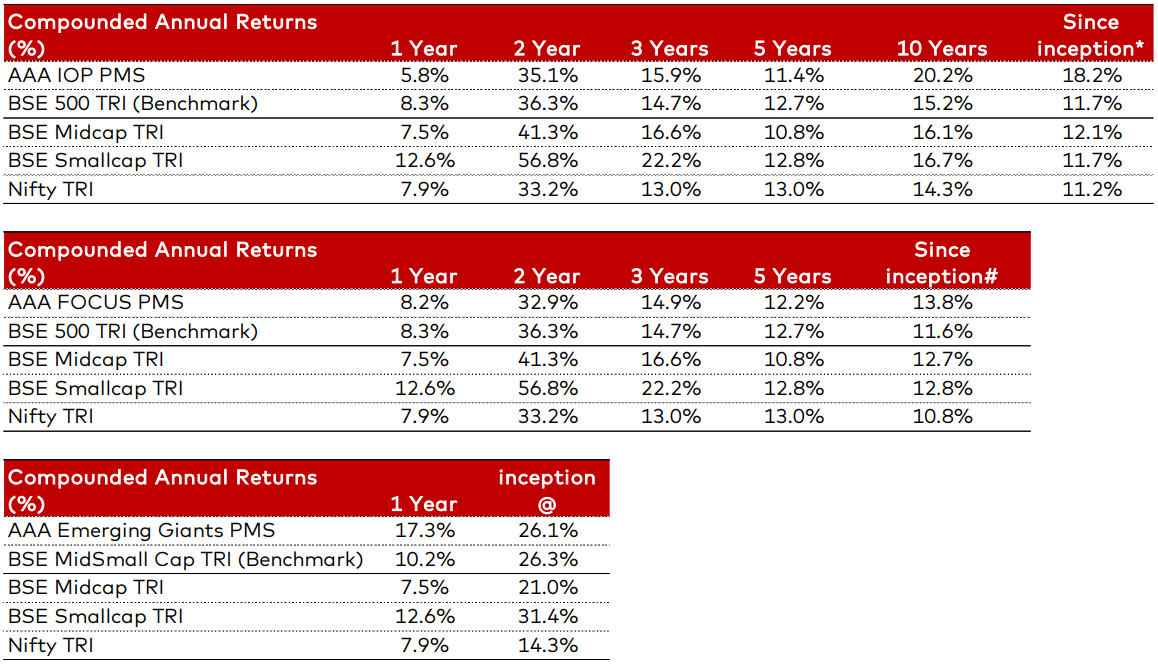

Corporate India 4QFY22 result season is over and we must say that Corporate India Inc delivered a reasonable satisfactory performance in challenging times. While India faced the third wave of Covid-19 in Jan 2022, in March 2022, Corporate India faced supply chain issues along with spiralling commodity prices due to the Russia-Ukraine war. In such challenging times, during 4QFY22, AAA IOP PMS portfolio reported strong revenue growth of 27%, outperforming Nifty revenue growth of 20%. In terms of EBITDA growth as well, the portfolio did exceedingly well by delivering growth of 29% vs Nifty Operating profit growth of 14%.

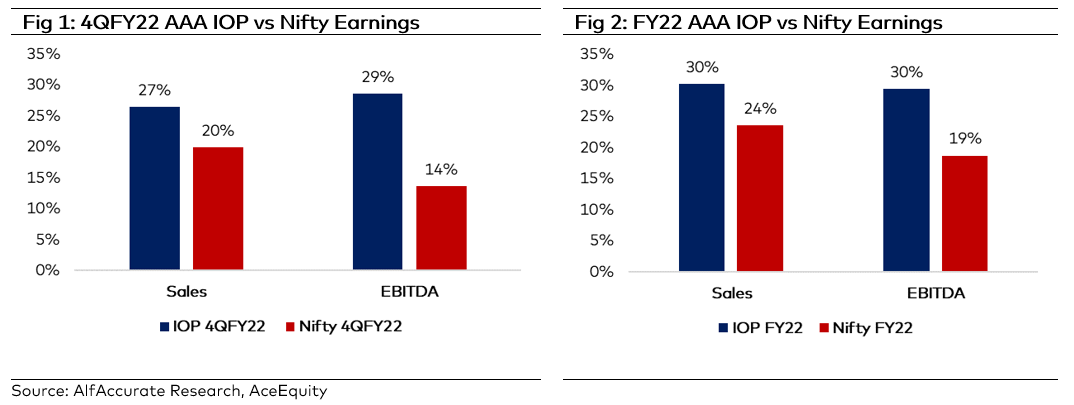

We have been bullish on the Specialty chemical sector for more than five years and our stand remains positive even today as the companies are continuing to get traction from their global customers. We have increased our weightage in the capital goods sector over the last twelve months and our outlook for this sector continues to remain positive as most of the companies reported the highest order inflow and order book in the last ten years. A detailed analysis of our portfolio holdings compared to its peer group has been given in the table below:

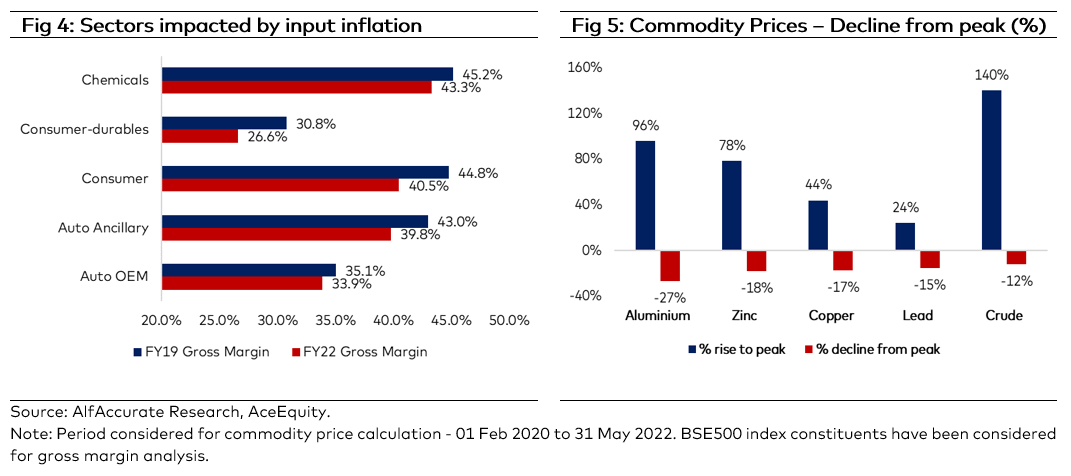

Back to inflation, across sectors, corporate India has witnessed pressure on gross margins (Ref Fig4) and that is likely to continue even during 1QFY23, as it takes typically one to two quarters to pass on the full cost increase to the end customers. We believe that collective policy actions by global central bankers are bound to slay commodity prices and will bring much-needed relief to the sectors which were reeling under input pressure in 2HFY23. The recent cooling-off commodity prices is a positive sign (refer Fig5).

Wild market swings in recent times are a reflection of investors’ apprehension of the path forward. Inflation remains hot, and Fed is determined to keep its swift pace of hiking. War continues to rage in Ukraine and countries are still actively considering sanctions, disrupting energy supplies. In such a volatile scenario, it is natural for corporates to give cautious commentary as rising commodity prices and complex supply chain issues adversely impact their profitability. India is relatively less impacted and benefitted from what we call, the “China+1 policy”. Strong export growth, lean corporate India balance sheet, cleaner Bank balance sheet, and revival of capex are the silver lines contributing to the resilience of the Indian economy, which is indeed, the fastest growing economy in the world.

While market volatility looks set to continue, the selloff has brought valuations across stocks to more reasonable levels. Nifty now trades below both its 5 and 10-year averages. In 2021, the market was in euphoria as companies with poor fundamentals outperformed companies with good fundamentals. In our view, that is not sustainable, and we have witnessed some reversal of that trend in the recent market correction. While it is hard to call a bottom, the time right now seems to be a good entry point for those invested for the long term. The important thing for investors is to remember is that in prior crises, markets have found a bottom well before the coast was clear.

Key Risks: Supply chain disruptions, faster than expected monetary tightening, geopolitical risks.

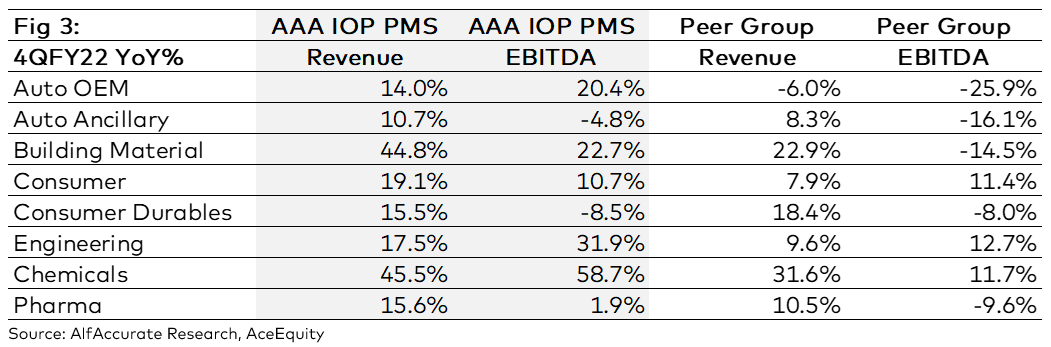

AAA PMS Performance