The year 2022 has finally come to an end. S&P 500 was down almost 20% by the year’s conclusion, and Nasdaq was down about 32%. Nifty 50, however, was up 3%. This occurred despite the widespread turmoil in other developed and emerging nations, as well as the $33.3 billion net FPI redemption. By investing $39.2 billion domestically, Indian investors boosted the market’s spirits and contributed to India’s resilience and strength. While others think this decoupling will only last a short while, we think it marks the beginning of “India’s Decade,” a new period of growth and prosperity. Now, let us zoom into India.

1) This time it’s different

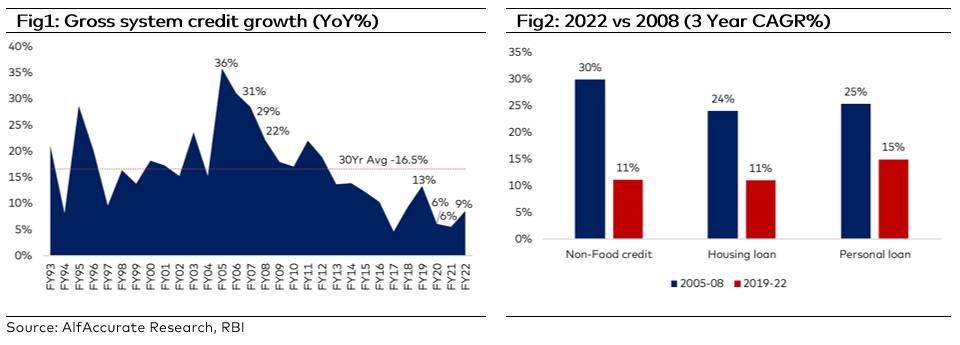

In contrast to the global financial crisis of 2008, when the credit market, and real estate markets heated up, the foundations are strong enough this time around and can withstand a potential global recession in 2023. This is demonstrated by the gross system credit growth rate, which peaked at 36% during the global financial crisis but is now just 9%. The corporate debt to GDP ratio, which is currently under 51% compared to a staggering 65% in 2008, is another sign that the road would be less tumultuous.

Apart from this, the banking system in India is recovering from a 7-year NPL cycle, but banks are nonetheless well funded, fundamentally positioning them to support solid credit expansion. The slippage ratio is under control at 1.7%, a significant decrease from the 5.2% level during the market slump in FY18. As the net debt to equity stands at 0.53x after the pandemic, financial sheets are much leaner with debt decreasing from the pandemic levels.

2) Manufacturing as an avenue of growth

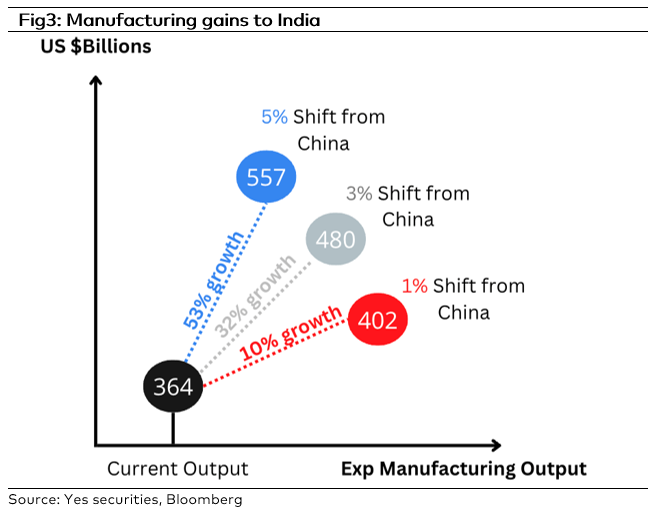

Since 2014, the government has been eager to increase India’s manufacturing base and boost homegrown products’ competitiveness abroad. Supply-side problems have been lessened due to a lower corporate tax rate, the implementation of the GST, greater infrastructure expenditures, the improvement of logistical challenges, liberal FDI policies, and other legislative initiatives.

The benefits of these have started to accrue, with an increase in the percentage of international orders going to Indian businesses. The chemical, engineering, and auto-related industries all demonstrate this. In addition, multinational corporations have begun investing more in their Indian subsidiaries and started using India as a base for some of their international exports as they have grown more confident in India’s capabilities. Announcements by a host of companies like Schaeffler, Cummins, Timken, Ingersoll-Rand, Foxconn, Wistron, are glaring examples of India’s attractiveness to global players. In the next five years, the greatest advantage shall be realised, with an expected expenditure of over Rs. 2.47 trillion for the Production Linked Incentive (PLI) scheme. This will lead to Capex of USD21 bn resulting in a boost in revenue from USD12.5 bn in FY22 to USD 65 bn in FY25.

Thus, the combined impact of all these variables would strengthen India’s position as a global player and boost our economy. Consider the following scenario: just a 3% transfer in manufacturing from China to India will result in a 32% rise in India’s manufacturing output as illustrated below.

3) Digital Leverage

India’s wave of digital inclusion has opened the door for new growth opportunities and advantageously positioned the country to profit from upcoming technological and innovative advancements. Nearly 95% of the population now has a digital identity card thanks to the Aadhar Card, which has significantly increased digitalization throughout the nation. Additionally, UPI has changed the payments environment leading to five times as many digital payments in the last five years. Greater advancements in the democratisation of lending, such as the Account Aggregator and Open Credit Enablement Network (OCEN), would create more opportunities. India is therefore anticipated to have an unrivaled digital infrastructure, which would lead to the best possible use of future improvements and faster growth. India crossing 100 unicorns is one such testament to this trillion-dollar tech ecosystem opportunity unfolding in the next decade.

4) High Retail Investor Confidence

The resurgence of domestic investors has been the highlight of Indian capital markets in the last few years. When it comes to structural liquidity support during any significant market decline, domestic institutions and retail investors have established themselves as the backbone of the Indian equities markets. As of March 31, 2022, the total stake of Retail, HNI, and DIIs in businesses listed on the NSE hit an all-time high of 23.3%, much above the percentage of FPIs, which was 20.2%. Although it is uncertain whether all of the increased equity interest will continue, there is a definite trend towards more financial savings.

Conclusion:

Thus, in a global economy that is in flux, India stands out. Formalisation, China +1, digitization, and infrastructure development, has already laid the foundation for India’s emergence over the past five years. The early benefits of these trends are already apparent. The capex cycle will further be boosted by the lower commodity inflation and improved corporate and banks’ balance sheets. We think India will certainly rise to its glory in the upcoming ten years. We, therefore, view the current global macroeconomic unrest as the ideal time to invest in India for the ensuing ten years.

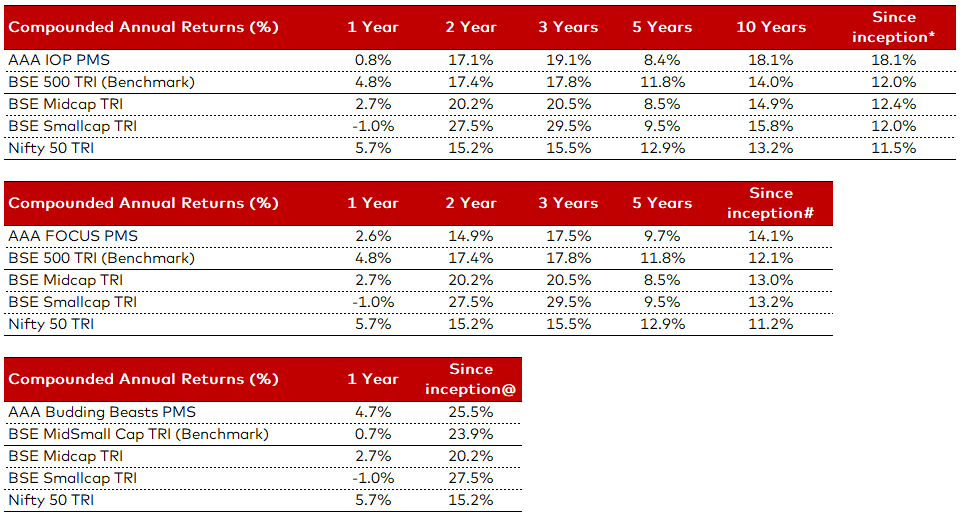

AAA PMS Performance