FY21 was one of the most challenging years for corporate India as the world grappled with the pandemic. During the last financial year, each quarter had its own set of challenges. In 1QFY21, corporate India experienced a collapse in demand, while in 2QFY21, it faced labour shortage issues. Lastly, in 4QFY21, it experienced supply chain issues with rising raw material prices.

Our time-tested 3M investment approach (Market size, Market share, Margin of safety) once again proved its resilience in such dynamic and complex business cycles. This further re-emphasises our belief that leaders are better equipped to navigate the ups and downs of business cycles than their peers. As our portfolio companies prevail dominant in their respective sectors, they sail through this valley of volatility with distinction. For instance, in 1Q of lockdown, our portfolio company Britannia Industries was the first company to deliver its biscuits through the Dunzo app at the consumer doorstep. Its strategy paid off exceptionally well, as it witnessed a 26% growth in revenue and 100% growth in net profit in 1QFY21. Similarly, in 4QFY21, when supply chain issues severely impacted most companies in the chemical/pharma sectors, our portfolio companies were the least impacted due to their diversified supply bases, focus on localisation and strong balance sheets.

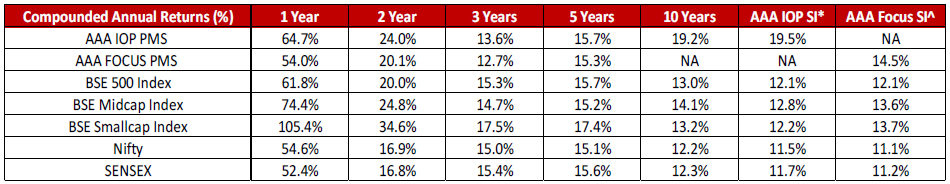

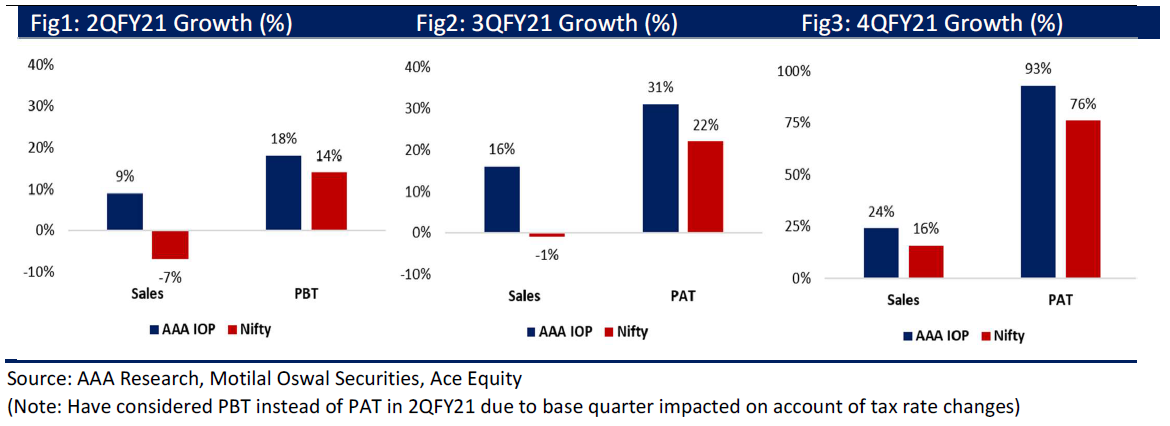

This sectoral leadership characteristic resulted in our portfolio reporting a more robust growth than the Nifty Index during each of the quarters in FY21. As seen in the figures below, during 2Q/3Q/4Q, our portfolio delivered revenue growth of 9%/16%/24% versus Nifty revenue growth of -7%/-1%/16% respectively. Overall, in FY21, while Nifty reported a dip in revenue of 5%, our portfolio reported a revenue growth of 8%. Backed by a strong balance sheet (most of our companies are net cash/low leverage), these companies are making significant investments in their business, further improving their return on capital employed.

Mega Trends to Accelerate

In early FY21, we identified three major trends for portfolio construction:

1. Acceleration of formalisation; 2. China + 1 strategy; 3. Automation and Innovation (Refer Key Investment Themes to Capitalize on the Covid-19 Crisis). Each of these themes have resulted in a good financial performance for our portfolio holdings, in turn yielding high stock returns. We expect these trends to gain momentum as India opens up its economy as summarised below:

1. Acceleration of formalisation

The pandemic accelerated the pace of formalisation from the unorganised to organised sector due to supply chain challenges. A weak balance sheet further weakened the position of the unorganised players as both lenders and suppliers became extremely conscious while extending credit lines. Consequently, our portfolio companies further gained notable market share, despite low advertisement spending.

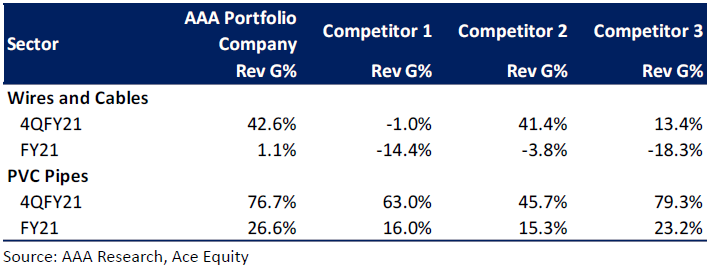

For example, in the wires and cables sector, our portfolio company, Polycab gained market share, due to the working capital squeeze faced by the unorganised sector due to a 45% increase in the price of copper. Similarly, in the PVC pipe industry, our portfolio company registered an industry-leading volume growth of 4% against the industry de-growth of 15%. Moreover, its tie-up with the leading CPVC resin manufacturer opened up new avenues for growth in B2C and B2B segments.

In the fragmented steel pipe industry, our portfolio company APL Apollo Tube’s comprehensive product range and strong distribution network enabled it to improve its market share from 40% in FY20 to 50% in FY21.

2. China+1

As global players seek to de-risk their supply chains from China, we believe many Indian companies are at an inflection point, particularly in specialty chemicals, pharmaceuticals, and electronics sectors. We identified this opportunity in 2018 and further increased our weightage in these sectors during 2020.

In the specialty chemical sector, our portfolio companies are witnessing an increased demand from their customers. For instance, Navin Fluorine, won a seven-year contract (three times its current revenue) to supply High-Performance product (HPP) in the fluorochemicals space to the innovator against many Chinese and European players. Sumitomo Chemical India announced the capex to supply four products to its parent company in order to reduce the dependence on China. To meet the increased demand, they plan to make investments equivalent to their last five years capital expenditure, implying strong traction from customers.

In the electronics sector, Dixon has the capability to manufacture almost half of India’s LED bulb and LED TV market and one third of India’s semi-automatic washing machine market. Its successful growth journey of getting deeper into the wallet share for individual brands and creating fungible assembly lines has enabled it to multiply its revenue by eleven times over the last nine years. This has strongly convinced us that Dixon will be the largest beneficiary of the various PLI schemes, including Mobile, Lighting, Air Conditioners, IT Hardware, Telecom Equipment (subject to approval from Govt) and further increase its revenue by 400% over the next five years.

3. Automation and Innovation

The world continues to evolve at an increasingly rapid rate. While the changing consumer behaviour (online retail, online payment, online gaming, etc.) is well documented, digital transformation in the industrial sector is much less discussed. Thanks to the sophisticated offerings from key automation companies, industrial automation is gathering pace. This is coming at a time when India’s capex cycle is at the cusp of a recovery. Rising Industrial automation and improvement in the capex cycle make us optimistic on the engineering sector, leading us to increase our weight in this space during the last nine months. Our portfolio companies like 3M India, Honeywell Automation, and ABB India, backed by strong parentages, are uniquely positioned to partner with customers and provide smart solutions. For instance, ABB’s recent commissioning of a digital integration platform for Sunflag Iron and Steel is its first global implementation in the metals industry.

Equity market strategy

We expect 1QFY22 to be impacted as India experienced the second wave of the pandemic. However, unlike 1QFY21, the effect is likely to be less severe considering fewer restrictions on the movement of goods. States have started to ease lockdown restrictions over the past few weeks. In addition, a robust global recovery will further help the export-oriented sectors. The government has also announced new measures – a combination of credit guarantees for Covid-19 affected sectors, development of healthcare infrastructure, and assistance to the agricultural sector. The credit guarantees combined with the on-tap liquidity windows announced by the RBI earlier for healthcare, is likely to support credit flow. As per the market estimate, Nifty is expected to report strong earnings growth in FY22, driven by a low base of FY21 in a few sectors and a significant increase in companies’ profit in the metals/mining sector. We expect our portfolio companies’ earnings to grow strongly at 30%+ along with high returns on invested capital and superior cash flows, as they benefit from megatrends. While short term correction cannot be ruled out, we remain positive on equity market with a 3 to 5 years’ time horizon.

Key Risks: Severe Covid third wave, the slower vaccination drive, significant increase in crude oil prices, geopolitical risks.

AAA PMS Performance