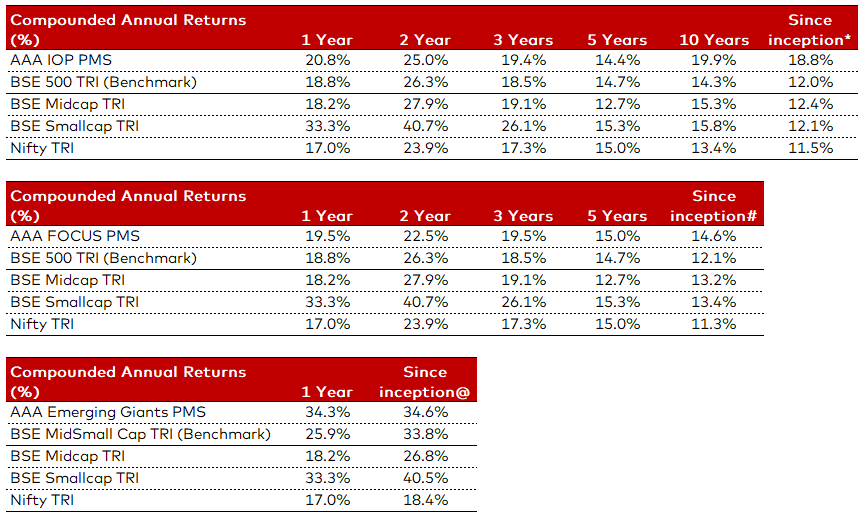

Geopolitical tensions involving Russia and Ukraine have been a source of market volatility in recent weeks. As Russia is one of the largest commodity producers, any delay in resolving the issues would impact the outlook for global inflation and economic and earnings growth. Until more visibility on a new equilibrium between Russia and West emerges, markets may remain volatile. Looking further out, equity markets have historically powered through geopolitical events. Since 1980, we have seen 11 meaningful events, with the S&P 500 falling 6.5% on average, and taking average 16 trading days to recover to its prior level. For Sensex, the average decline was 10%, and it took average 38 trading days to recover as depicted in Fig1.

Solid performance delivery by AAA Portfolio

During 3QFY22, AAAIOP PMS portfolio companies delivered solid performance by registering Revenue/EBITDA/Net Profit 2-year CAGR of 18.9%/17.5%/23.4% respectively. This was against Nifty-ex commodities Revenue /EBITDA/Net profit 2-year CAGR of 12.8%/11.2%/18.1%. They continued to deliver robust performance despite headwinds, particularly due to rising raw material prices and supply chain bottlenecks.

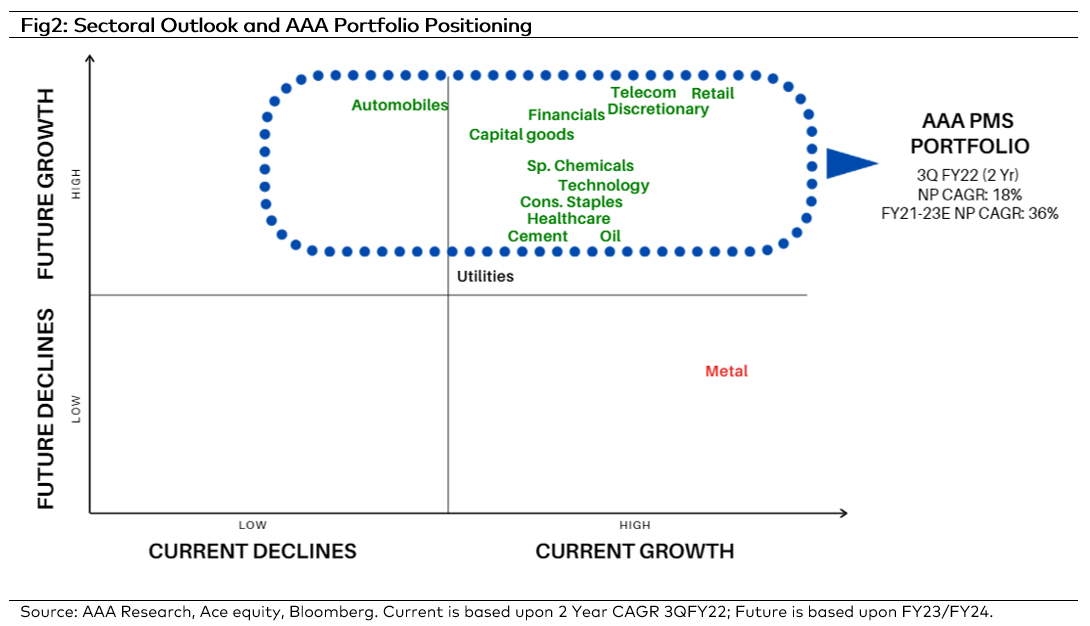

Sectoral Outlook

We show in Fig2, how we think about the growth prospects of the major sectors. We expect consumer discretionary, speciality chemical, capital goods, banking and automobile sectors to deliver higher earnings growth over the next 2-3 years and we are well positioned to benefit from the same.

Post a three-year struggle and the consequent underperformance, the auto sector looks set to deliver strong growth for the medium term driven by new product launches (car segment) and easing semi-conductor issues. Replacement demand and revival in the economy will lead to upcycle in the commercial vehicle segment. In the speciality chemical sector, increasing order inquiries along with an increase in capital spending align with our strong view about long-term growth prospects. Further, the CRAM opportunity for selected players and China+1 will remain major growth drivers for the sector.

In the consumer space, we believe the pressure on rural India will continue to adversely impact the staple segment. Consumer discretionary, on the other hand, is expected to witness a strong recovery. Organised retail, building material, paints, jewellery, and durables, are seeing strong underlying revenue momentum driven by increased disposable income with households, home improvement demand, and market share gains by the sector leaders. In the capital goods sector order inflow has been robust across companies largely led segments like renewables, warehousing, data centres etc. Revival in capex in domestic market and structural shift towards industrial automation makes us positive on capital goods sector.

Market Outlook

We expect the market to remain volatile with the Russia-Ukraine conflict reaching a flashpoint. It also presents central banks with a dilemma: Should they raise rates aggressively due to the threat of higher inflation caused by rising energy prices or should they react to the decline in spending power and consumer confidence (by slowing monetary tightening)? Despite near term concerns, we continue to believe that India’s long-term structural story is intact. Corporate India has become much stronger to weather the near-term headwinds. We continue to remain nimble and stick to a portfolio strategy based upon our prevalent framework that is buying the businesses with resilient fundamentals – strong earnings growth and low leverage.

Key Risks: Supply chain disruptions, faster than expected monetary tightening, geopolitical risks.

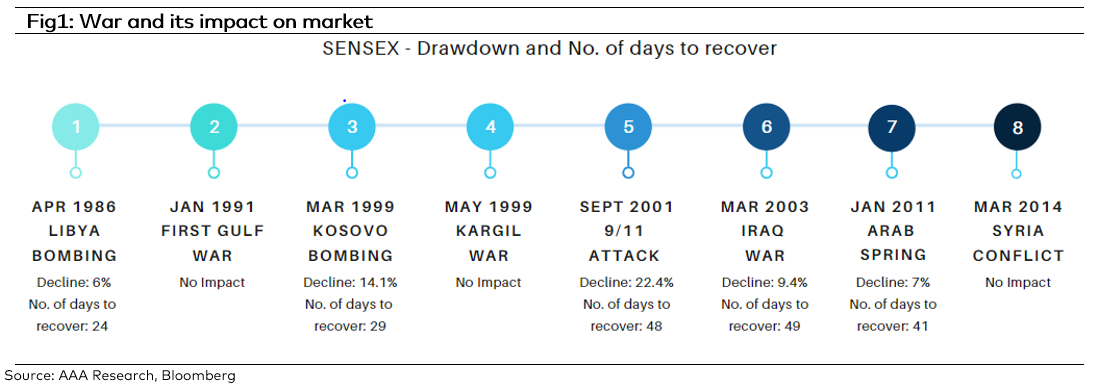

AAA PMS Performance