European and American markets have broken the June lows. Fed continues to push hard on interest rates, with Jerome Powell declaring 4.5% as the terminal interest rate by next year. While the global outlook looks gloomy, there is some sunshine that can foster India’s economy forward globally. Amongst the global turmoil, Europe specifically has been grappling with an unprecedented rise in power and fuel costs, with gas prices rising multi-fold to $70/MMBTU in Aug22 from $3/MMBTU in Aug20. This has substantially impacted the profitability of European companies with the possibility of further production shutdowns in the upcoming winter. We believe that these severe cost pressures will further expand the diversification of the manufacturing bases from the Western hemisphere to the Eastern hemisphere and add to the rising export opportunities which we outlined in our April 2022 insights.

Advantage India

The shift of manufacturing to a low-cost base in the last decade greatly benefitted countries like China, Vietnam, and Mexico, by helping them gain larger export shares. India is now in a great position to grab export share at a faster pace in the global market. This has been made possible by the culmination of several key factors, including a stable political regime, FTA agreements with developed countries, government efforts to increase manufacturing through the PLI scheme, more ease of doing business, and globally competitive corporate tax rates. India’s exports have already started rising, particularly in the chemical, capital goods, and auto components in addition to the traditional sectors like IT, pharma, and textiles.

Advantage AAA Portfolio

We expect three business types to stand to gain from increased export opportunities to Europe:

1) MNCs with a presence in India

2) Indian exporters having a large global presence

3) Domestic leaders identifying exports as a new growth opportunity.

While opportunities are galore, only the companies that have a proven track record with technical capability, ability to scale, balance sheet strength, and cost structure will emerge as winners. AAA portfolio is effectively positioned to capitalise on these strengths as outlined below:

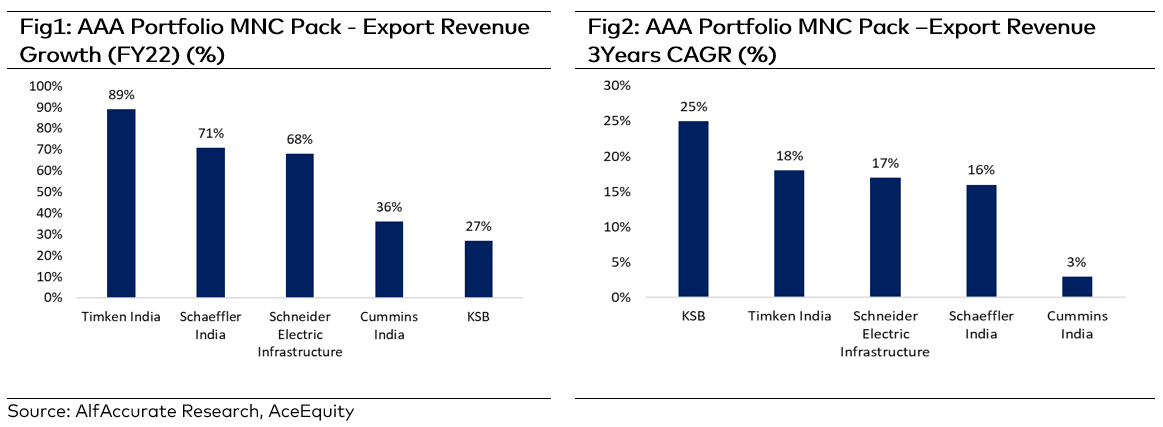

MNCs with a presence in India

In the last 3 years, we have seen an increasing number of listed MNC companies recognising India as an important sourcing destination. Indian subsidiaries of overseas companies are getting their facilities approved for export and in some cases, adding incremental capacities for export. We have also observed improvements in the technical capabilities of Indian entities led by changes in emission norms.

For instance, Cummins India sees significant export tailwinds in the United States and Europe after the implementation of new emission norms in India, thereby making it ready to manufacture products for the West. Schneider Electric India has also announced its plans to expand its capacity of vacuum circuit interrupters and MV vacuum breakers by 2.5x for exports to Schneider Global. Schaeffler has announced to permanently shift manufacturing of key product lines to India. This move will greatly benefit Schaeffler India, a AAA holding. Additional capital expenditure of Rs. 1000 crores will lead to an expected rise in its market share to ~25% of overall industrial imports by the group from ~6% currently.

We continue to look for such opportunities of MNCs with a strong domestic hold and an increasing intent to make India their export base for the group.

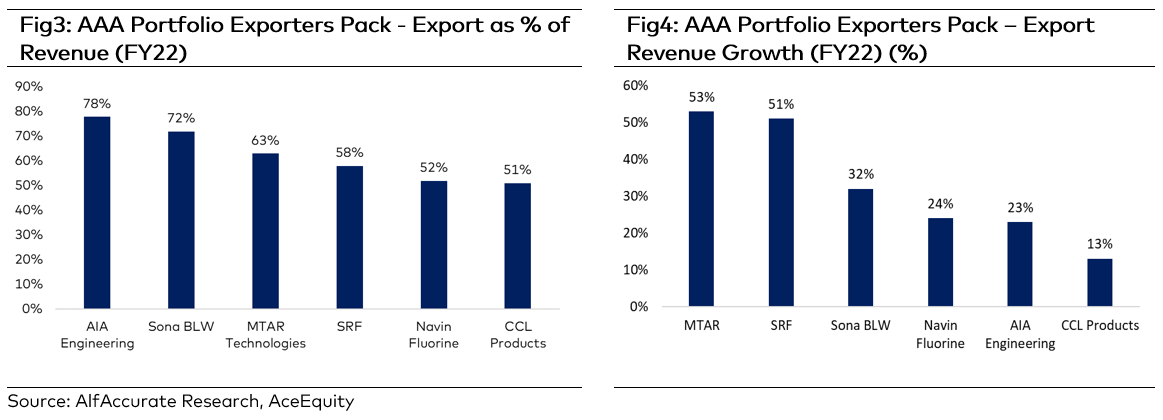

Indian companies having a large global presence:

As a part of our 3M Investment framework, while identifying companies in the manufacturing sector (B2B), we always look for cost competitiveness in companies as a key moat. That coupled with an existing established global client base allows companies to grow exponentially. Many of our portfolio companies in specialty chemicals, industrial goods, auto ancillary, die-casting & forging sectors have announced export-linked capital expenditure in PLI. With ready customer approvals and a proven track record of timely deliveries, these companies are the first choice for global companies.

Particularly in the specialty chemical sector, European Chemical players’ economics are now under threat due to high energy prices. This could further compel European players to start collaborating with Indian companies, which would benefit our portfolio companies like SRF and Navin Fluorine as they are rightly positioned for rising opportunities in CRAMS and cGMP manufacturing. Both these companies have an impressive track record in winning new orders and are planning to make a significant capital expenditure in the next three years, which is estimated to equal their capex in the last ten years. As a result, we expect a revenue CAGR of 25% for SRF and 40% for Navin Fluorine during FY22-25.

Domestic leaders see exports as new growth opportunity

Having already gained dominance domestically, a few large domestic manufacturers are now turning their eyes to pursuing exports as a new avenue of growth. Uno Minda, a AAA holding, is the leading player in the domestic auto ancillary market and is now eyeing to secure orders from international OEMs for its switches division. Craftsman Automation has secured Rs250crs order from Stallantis for aluminum forging – diversifying the customer base from domestic 2W OEMs. We continue to hunt for such companies which will be beneficiaries of the acceleration of outsourcing from India.

Market outlook

The US Federal Reserve hiked the policy rate by 75 basis points, the third straight increase in interest rates since June. It has pledged to keep hiking interest rates until inflation returns close to the bank’s target of 2%. While teetering global economy and turmoil in markets, the Indian equity market continued to demonstrate resilience compared to other emerging markets. While we expect the market to remain volatile, we remain constructive on the Indian equity market, given the strong domestic economy, and healthy corporate balance sheet. We believe that right stock selection can continue to offer investors better returns compared to other asset classes for a long-term investment horizon.

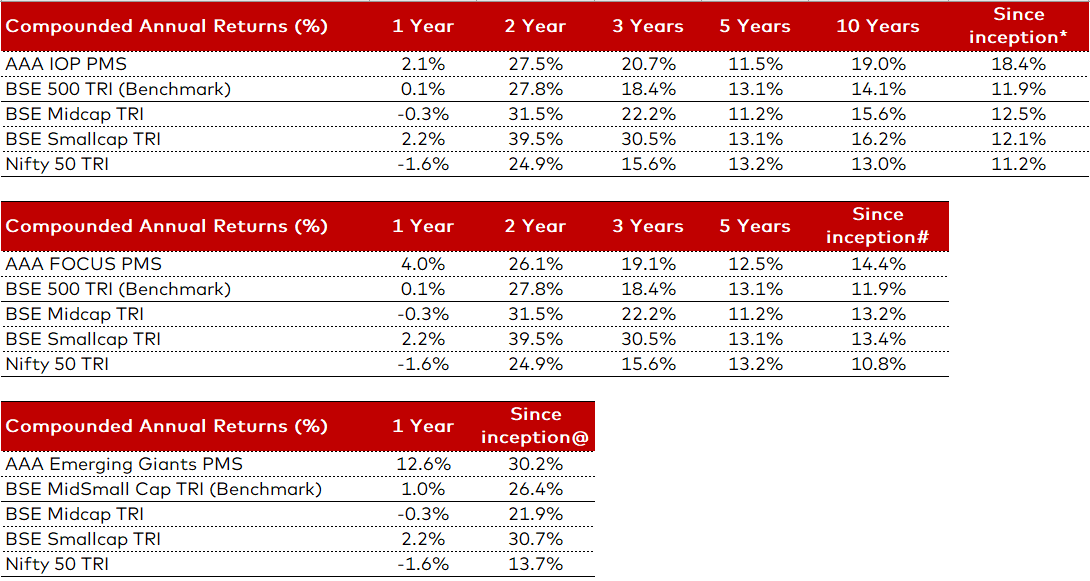

AAA PMS Performance