March 2021 will mark one year since the WHO declared Covid19 as a global pandemic, upending lives and livelihoods. The pace of disruption is accelerating at an unprecedented rate. As Mckinsey puts it, “Speed has been a fundamental characteristic of the COVID-19 pandemic—the virus hit fast, businesses reacted rapidly, reorganizing supply chains, adopting remote-work models, and speeding up decision making with surprising velocity. Vaccines were created with unprecedented swiftness. And as with prior crises, the organizations that acted quickly to counter the COVID-19 downturn dealt with the disruption better than the organizations that reacted more slowly”.

At AAA, we keep a tab on what global CEO’s think about the world’s future in this dynamic environment and their strategy to respond to those changes. In this AAA Insights, we have summarised a few global CEO’s views to give our readers some perspective on the world’s future:

Volkswagon – Redefining individual mobility

“Data and electricity are driving us now. We are providing over-the-air software updates – including new functions and assistance systems. Particularly in fully connected traffic, data will become the basis for autonomous driving, thus redefining individual mobility. This is why we are planning to invest €27 billion, representing about one-fifth of the Group’s total capex expenditure, in digitalization over the next five years.”

“We are establishing new sales processes, primarily online, and communicating directly with our customers – around the clock, if desired. We find ourselves in a new playing field – up against companies that are entering the mobility market from the world of technology, often with virtually unlimited access to resources through the capital markets. Stock market players still regard the Volkswagen Group as part of the “old auto” world. By focusing consistently on software and efficiency, we are working to change this view. The world’s most valuable company will become a mobility company once more – and Volkswagen enjoys one of the best starting positions in the “new auto” competition.”

Tesla – Autonomous driving to become a reality soon

Autonomous driving- “I’m confident, based on my understanding of the technical roadmap and the progress that we’re making, that it’s not remarkable at all for the car to completely drive you from one location to another through a series of complex intersections. It’s now about just improving the corner case reliability and getting it to 99.9999% reliable with respect to an accident. Basically, we need to get it to better than human by a factor of at least 100% or 200%. And this is happening rapidly because we’ve got so much training data with all the cars in the field. And the software is improving dramatically.”

Increasing battery range – “We’ve improved the efficiency of cars dramatically, such that you can actually get a pretty good range even with the standard range battery pack (for Model 3, it’s approaching the high 200 miles). And some slight continued improvements, we’ll start to get to a 300-mile range even with standard pack (~500 kilometres).”

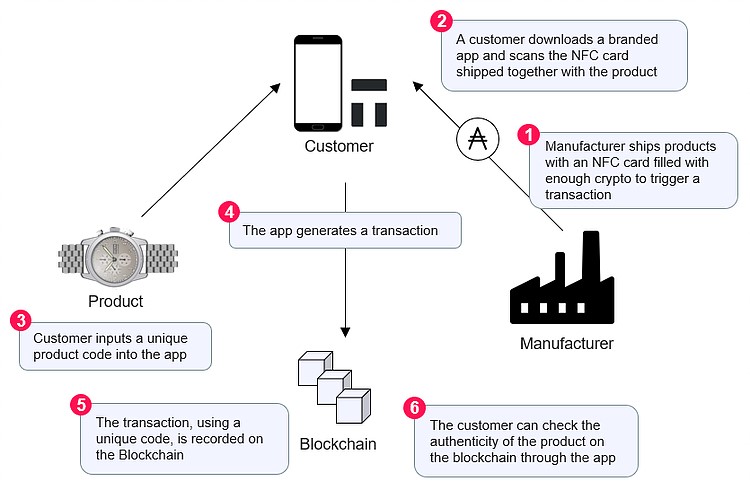

LVMH – Technology to stop counterfeit products

Louis Vuitton is developing a platform that uses blockchain technology to track luxury goods and stop counterfeit products from entering the market. The platform, which is called aura, will offer powerful tracking services to brands as well as tracing options to their consumers, giving them access to the lifecycle of products, including the design, raw materials, manufacturing, and distribution.

Using this same system, LVMH has developed aura as a way of authenticating luxury goods. Aura will keep track of exactly who is purchasing each piece at the point of sale, and will even go beyond and into the used goods market, making it harder to trade counterfeit product as they won’t be recorded within the certified blockchain system of genuine goods.

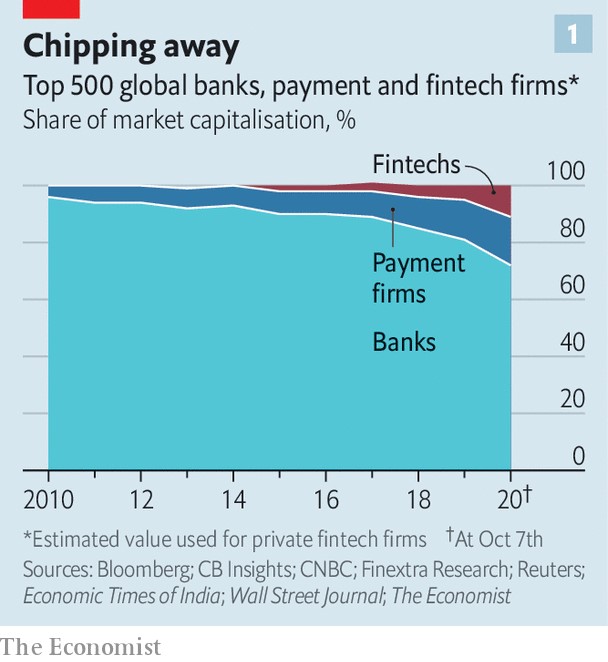

JP Morgan – Fintech: Scare to traditional banking?

“Every single business within JP Morgan, almost every single meeting we go through, is talking about what are we moving to the cloud, whether it’s internal or external? What are we adding, AI and machine learning? And are we getting the data analytics right? And it is global. We have a tremendous amount of AI being used in Asset & Wealth Management, CIB, in trading, in Commercial Banking prospecting, and it’s literally the tip of the iceberg.”

“Silicon Valley is coming. They’re strong; they’re smart. We now are facing a whole generation of newer, tougher, faster fintech competitors who – and if they don’t ride the rails of JPMorgan, they can ride the rails of someone else. I expect it to be very, very tough, brutal competition in the next ten years. I expect to win, so help me, God. Fintech valuations today trounce the valuation of JP Morgan stock. Visa, $500 billion; MasterCard, $350 billion; PayPal, $220 billion; Ant Financial, $600 billion; Tencent, $800 billion; Alibaba, $1 trillion. Facebook, Google, Apple, Amazon, you can go on and on. But absolutely, we should be scared about that.”

Johnson & Johnson – Building the 21st-century operating room

“Our industry is just starting to unlock the full potential and benefits of these robotic and digital technologies— to bring differentiated, cutting-edge new solutions to the 21st-century operating room. We remain incredibly excited about the great potential of the end-to-end digital surgery ecosystem and are simultaneously developing three differentiated robotic programs and recently achieved a significant milestone with the FDA clearance for our VELYS™ Robotic-Assisted Solution designed for use with the ATTUNE® Total Knee System.”

“Johnson & Johnson invested an all-time high of $12.2 billion in research and development (up $800 million from 2019) and more than $7 billion in acquisitions as we continued to fortify our pipeline.”

Qualcomm – 5G in hand, initiating on 6G

“5G commercialization continues to be strong.. we expect 1 billion 5G connections in 2023, and that’s two years faster than that same mark in 4G…If you look at IHS, in 2035, they think over $13 trillion of economic activity will be enabled by 5G. And QUALCOMM drives all of it. There’s going to be billions and billions of intelligent devices that are going to open up at the edge that are not going to be in a traditional handset form factor.”

“Talking about 6G – QUALCOMM always invest usually a decade before a new technology. We expect 5G to last for more than a decade, but 6G research is underway. As we look of the maturity of the mobile networks, especially with millimeter wave, they’re going to become more dense. We see a lot of potential with 6G to even go into higher frequencies. There is a lot of interesting technologies that can be applied to 6G.”

Microsoft – Digital Transformation

“The way people interact with businesses is fundamentally shifting, and there is no going back. Digital technology is the most malleable tool ever created, and we believe that businesses that use it to build their own digital capability will recover faster and emerge stronger.”

“Fifty billion devices will come online by 2030, and there will be 175 zettabytes of data by 2025, and processing this data in real time will be imperative for every organization. As much as 73 percent of the data in the world is still not being analyzed. 500 million apps will be created by 2023 to drive transformation and productivity for every organization. Three billion people around the world look to gaming for entertainment, community, and achievement, and our ambition is to empower each of them, wherever they play.”

“To accelerate this, we must enable a new category of developers—citizen developers—equipping domain experts with tools that are low-code or no-code to create solutions that solve their unique business needs and help them better collaborate with professional developers.”

Facebook – Big tech to empower small businesses

“Supporting small businesses also continues to be a major focus for us and it’s more important now than ever. The Facebook Shop tab gives people a dedicated place to shop and find products; the Facebook Small Business Suite lets businesses easily manage their presence across our apps; and Paid Online Events lets businesses, creators and educators make money by live-streaming classes, talks and other events.”

“In WhatsApp, we just announced how we’re going to make it easier for people to buy products directly within a chat, and integrating WhatsApp business features with Facebook Shops so that way, when a small business sets up a shop, they can now establish, or will be able to establish a commercial presence across Facebook, Instagram and WhatsApp all at the same time.”

Investment strategy and Market outlook:

FY21 was a year of magnificent equity rally as Nifty registered a gain of 71% supported by monetary policy, steps taken by governments, and, importantly, positive surprise corporate earnings performance. On valuations, Nifty trades at PER of 21.8x on FY22 and 18.5x on FY23 compared to its 10 years average PE 1 year forward) 18.8x . Given benign interest rates environment, government’s thrust on reforms and strong corporate earnings growth prospects, we remain positive on equity market with a 3-5 years time horizon.

Key risks: Recent surge in Covid-19 cases led by a second wave of the pandemic, reduced policy support by global governments and central bankers, rising commodity prices leading to higher inflation, and geopolitical shocks.

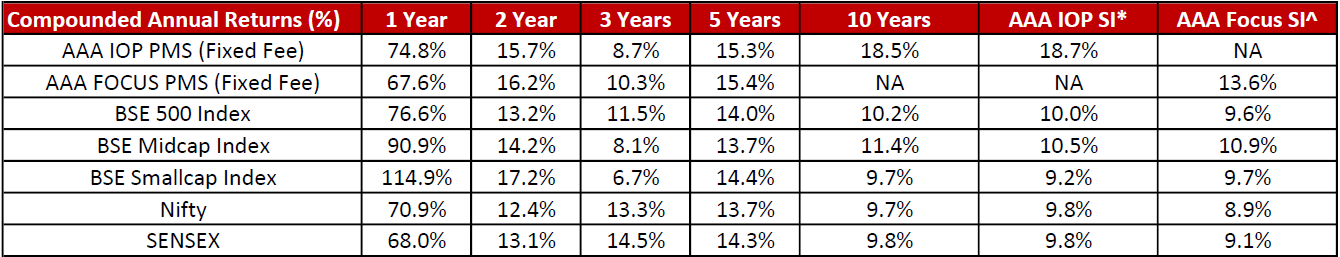

AAA PMS Performance

*(23 Nov 2009 – 31 Mar 2021) ^ (7 Dec 2014 – 31 Mar 2021) (Performance after all expenses).

Note: Returns of Individual clients may differ depending on the time of entry in the Strategy. Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance-related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.