“Change is inevitable in life. You can either resist it and potentially get run over by it, or you can choose to cooperate with it, adapt with it, and learn how to benefit from it. When you embrace change you begin to see it as an opportunity for growth.”

– Jack Canfield, American Author

We started “Future from the lenses of the Global CEO” series in 2021 (link). This series gives us insights into what global CEOs think about the world’s future in this dynamic environment and their strategy to respond to those changes. After scanning nearly two dozen global companies’ annual shareholder letters and transcripts across US, Europe, and Asia, themes that had emerged prominently are DISAC: Digital, Innovation, Sustainability, Automation, & China +1. Once we divulge these details and try to connect from the Indian context, we see the significance of these trends visible in many of our investment companies.

In this series II, we have summarised a few global CEOs’ views to give our readers some perspective on the world’s future:

Cummins – Decarbonisation Opportunity

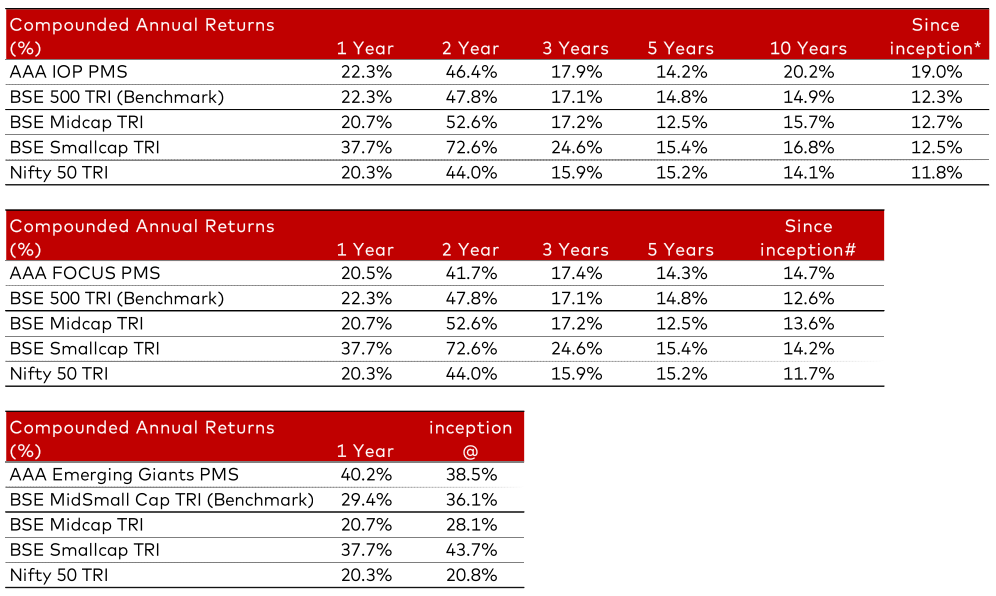

Decarbonization is a large opportunity for Cummins, considering ~USD 1 bn investment in newer technologies like a broad portfolio of zero-emission solutions: fuel cell, electrolyzer, and key components in the battery electric power solutions.

Management added, “With our new product portfolio, we’re increasing our scope of supply and can nearly double our share of wallet. Today, with an ICE engine and transmission, we have access to 34% of a heavy-duty truck. We can now access up to 60% of a heavy-duty truck scope with a fuel cell system and nearly 45% with a battery electric system. Our strategy is to be both an integrator and a component supplier. We have some customers, for example Bluebird or Gilead, where we provide the entire powertrain system, and we work with them to integrate it into their bus and optimize it”. Based on the new products and its adoption the company estimates a 100 Bn USD market opportunity by 2030 (refer Fig 1).

Microsoft – Data is the new Oil

“Tech as a percentage of total GDP will double from 5 to 10 percent by 2030. But the most notable thing is what will happen to the other 90 percent. The digital transformation that was projected to happen over the next 10 years is happening today”

“No asset is more strategic than data. In the next three years, we’ll create more data than we did in the past 10. But our ability to make sense of data is growing more difficult as the volume, velocity, and variety expand. The leading indicator of digital transformation success can be measured by an organization’s ability to build predictive and analytical power.”

Ørsted – Decarbonising Energy

Ørsted, one of the five largest renewable energy companies in the world, says “…more than 70 % of the world’s carbon emissions are coming from the production and use of energy. In 2020, more than 75 % of all new power generation capacity commissioned globally came from renewables, up from 26 % just a decade ago (BNEF). The need to fight climate change by transforming our global energy systems will require a massive renewable build-out: Estimates by IRENA suggest that the renewable installed base, including hydroelectric, geothermal, and marine energy, will have to grow more than tenfold, from 2,500 GW today to more than 28,000 GW by 2050”.

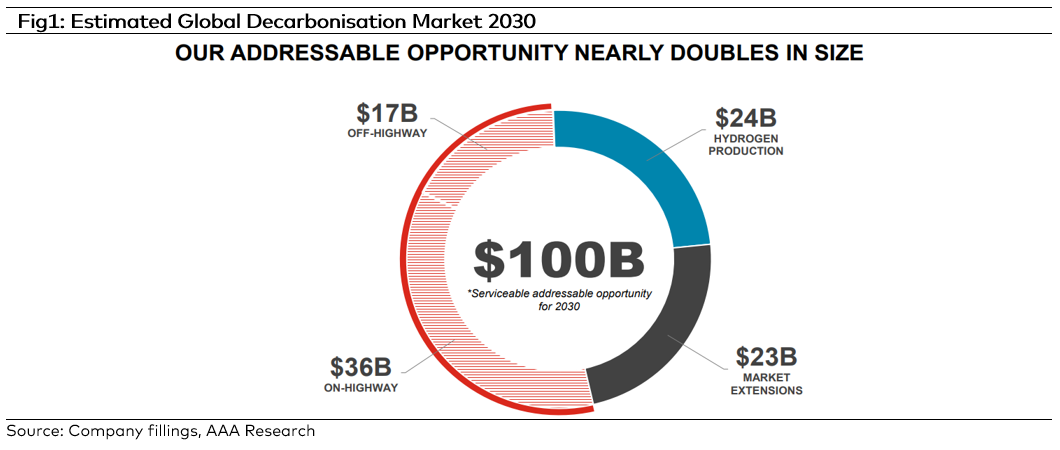

ABB – Targeting the upcoming EV Charging Solutions Market

In the next 5 years till 2026, the addressable market size of ABB E-Mobility would rise from USD 3.9 bn USD currently to USD 11.1 bn (Refer Fig2). Most of this market growth would be driven by high-power/regular DC charging followed by AC charging and then on top there would be servicing/maintenance and the software for the energy management.

Volkswagen – Going all Electric!!

“We don’t need higher fuel prices for the success of the EVs… EVs are already the better option, they are cheaper to run, cheaper to drive, they probably have higher residual values as well. So, I think this transition is on the way…. (We) aim for BEV share of 7% to 8% in 2022. Our ramp-up is doubling up once again this year, and then achieving 20%, 25% by 2025. And then 60% in Europe and 50% worldwide by 2030”.

Tesla – In a league of its own – from autonomous self-driving to Robo-taxis

“Full Self-Driving (FSD), so over time, will become the most important source of profitability for Tesla. The cars in the fleet essentially becoming self-driving via a software update, I think might end up being the biggest increase in asset value of any asset class in history. As Full Self-Driving features get rolled out… and

then as we work towards the Robo-taxi space …You just go from having an asset that has a utility of perhaps 12 hours a week per passenger car to maybe around 50 or 60 hours a week to a 5x increase in the utility of the asset. …We can get rid of a lot of parking lots if you have a car that is operating all the time. I think (it will be) way cheaper to go point-to-point with a robo-taxi, which is an autonomous Tesla which every car we’ve made in the past, three or four years, will be capable of that than a bus or a subway. This will cost less than the subsidized value of a bus ticket. Millions of cars suddenly have four or five times utility overnight”.

Taiwan Semiconductor Mfg. Co. (TSMC) – 5G and HPC megatrend

“While the short-term imbalance may or may not persist, we continue to observe the structure increase in long-term semiconductor demand underpinned by the industry megatrend of 5G and HPC (High Performance Computing) related applications. We also observe the higher silicon content in many end devices, including Automotive, PCs, servers, networking, and smartphones. As we embark upon, the 5G and intelligent and more connected work will fuel massive requirement for computation power and prepare greater need for energy efficient computing which demand greater use of leading-edge technologies”.

JP Morgan Chase – Taking Fintechs head-on

On increased IT Spending – “There’s a global competition, there’s neobank competition, there’s direct private lending competition, there’s Jane Street competition, there’s Citadel competition, there’s fintech competition, there’s PayPal competition, there’s Stripe competition. It’s a lot of competition, and we intend to win, and sometimes that means you got to spend a few bucks.”

“We spent $2 billion on brand new data centers. We’re running a whole bunch of major programs…, on AWS, and we’re working with Google and Microsoft to run some of the stuff in the cloud because we want to have multiple cloud capabilities. And this year, roughly 30%, 40%, 50% of all our apps and all our data will be moving to cloud-related type of stuff. This stuff is absolutely totally valuable. If you sat in this room and looked at the power of the cloud and big data on risk, fraud, marketing, capabilities, offers, customer satisfaction, dealing with errors and complaints, prospecting, it’s extraordinary. Like for example, with all the fraud and all the cyber and all the ransomware, our fraud costs were down this year”.

Market Outlook

The Ukraine war has led to a resurgence in commodity prices especially crude oil. This someway compounds the already high inflation problem prevalent right now. This is likely to impact corporate earnings growth for 4QFY22 and 1QFY23. However, the commodities will likely cool off once tangible signs of peace on the ground and trade flow normalisation are visible. While there are concerns and risks, we believe that the Indian economy is well positioned to weather the upheavals, given that the direct impact of the war is limited, the inherent potential that the country holds remains undiminished, and the strong good track record of the Government in responding to the crisis. There is also the government’s infrastructure and manufacturing investment push and the various reforms of recent years that will help cushion the indirect impact and keep the engines of growth running.

The last 2 years have seen several bouts of volatility – Covid lockdowns, supply shortages, sky-high commodity prices, change in Fed policy stance, and now Russia-Ukraine war. The key learning over this period has been to keep the focus on the quality of companies in the portfolio. Companies with strong management, robust fundamentals, and good corporate governance generally tide over and go on increase market dominance and hence profitability. Our AAA investment approach has greatly helped us in this regard. We advise investors to take advantage of short-term market volatility to add on to equity portfolios for the long term at good valuations.

Key Risks: Supply chain disruptions, faster than expected monetary tightening, geopolitical risks.

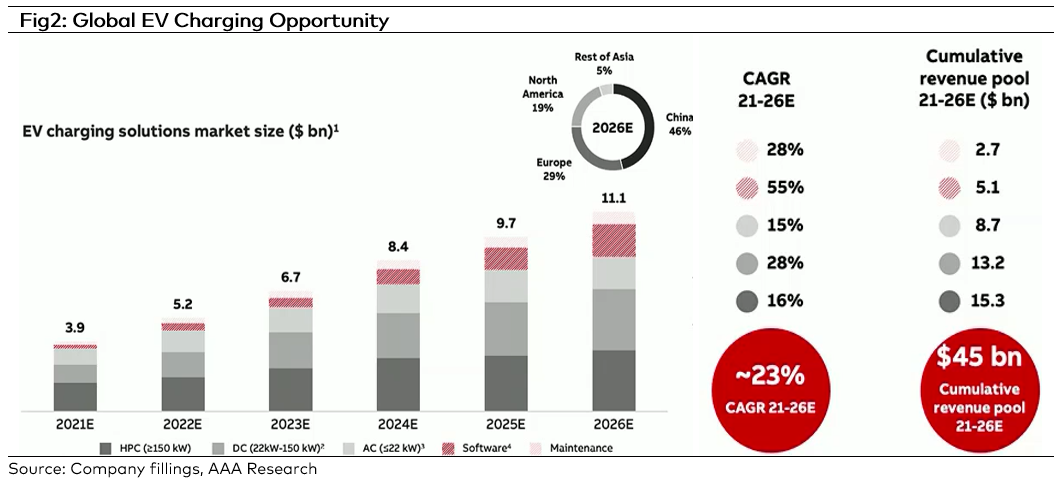

AAA PMS Performance