As a continuation of our “Future from the lenses of the Global CEO” series (link1, link2), we are providing insights into the perspectives of global CEOs regarding the future of the world in this rapidly changing environment and their approaches to adapting to these changes. We, as investors who focus on long-term equity, consider it essential to identify these revolutionary trends and the companies that are capitalising on them to produce stable positive returns in the equity market. Our objective is to look beyond immediate gains and provide an understanding of some of the major patterns that may shape the global economy and financial markets in the next ten years. After analysing the annual shareholder letters and transcripts of nearly two dozen global companies across the US, Europe, and Asia, we have observed that Digital, Automation, Renewables, and Sustainability are prominent themes.

When we examine these trends and try to relate them to the Indian context, we can see their significance reflected in many of the companies we invest in.

In this series III, we have summarised a few global CEOs’ views to give our readers some perspective on the world’s future:

Caterpillar: Leading Autonomous Mining

Caterpillar has been a global leader in construction equipment segment for over 100 years now and is now investing behind autonomous technology to drive the future of construction and mining activities.

Autonomous mining trucks solution – Jim Umpleby, Caterpillar’s CEO remarks, “In mining, of course we have our autonomous mining trucks solution that’s making our customers up to 30% more productive in – compared to the best manned site. In terms of semi-autonomy, you can operate now three or four dozers remotely at the same time.” The result is that Caterpillar now has 525+ Cat autonomous trucks operating 24/7 on 20 mining sites worldwide. Using Cat Command technology, customers have safely hauled more than 4 billion tonnes and travelled over 155 million kms autonomously with 30% more productivity!

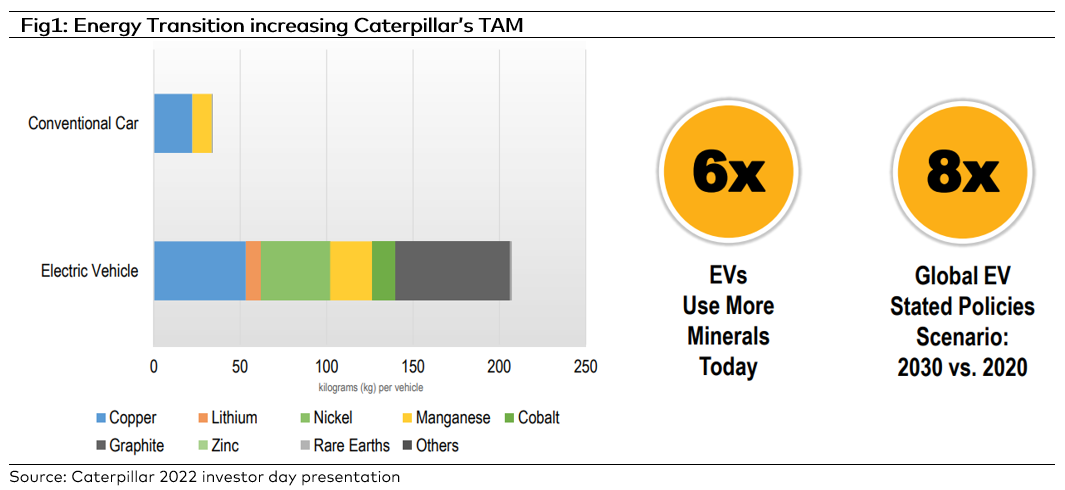

EV increasing TAM – Jim adds, “We firmly believe that the energy transition is increasing Caterpillars’ total addressable market. As an example, an average automobile that’s an electric vehicle versus an internal combustion engine automobile take six times as many minerals.”

LanzaTech: Recycling Carbon at industrial scale

Fashion retailer Zara rolled out a collection of little black dresses last winter made from a surprising ingredient: recycled carbon. Their polyester material was developed from ethanol created by the Illinois–based startup LanzaTech at a plant adjacent to a Chinese steel mill. It’s one of LanzaTech’s three commercial-scale facilities (all attached to Chinese manufacturing sites) that capture emissions before they can hit the air. The gases are diverted into LanzaTech bioreactors, where they are fermented into ethanol using microorganisms that have been tailored to feed on them. “Our [process] is just like a microbrewery, except we ferment carbon monoxide, hydrogen, and carbon dioxide,” says CEO Jennifer Holmgren.

Once the ethanol is created, LanzaTech’s buyers and partners turn it into other materials, from jet fuel to clothing. To date, the company has produced more than 40 million gallons of ethanol, offsetting 200,000 metric tons of CO2. Jennifer adds, “with L’Oréal we are working with Total to convert the ethanol to polyethylene for cosmetic packaging; with Mibelle we are using it directly as a cleaning alcohol and with Unilever is being converted to surfactants for use in laundry capsules. We can see a future where products are “carbonsmart” inside and out and where the carbon in the packaging is locked into the material cycle!”

Siemens: Green Hydrogen Enabler

Green hydrogen is a versatile energy carrier that can be applied to decarbonize a wide range of sectors. It can be used directly or in the form of its derivatives like e-methanol, e-ammonia, or e-fuels to replace fossil fuels, coal or gas. Generating green hydrogen efficiently from water and renewable energy requires innovative solutions as renewables like the sun and wind are often volatile.

Siemens Energy is engaged in front-end engineering and design for 1.8 GW of Silyzer 300 polymer electrolyte membrane (PEM) electrolyzers for HIF Matagorda eFuels Facility. This will use renewable energy to separate hydrogen from water, resulting in approximately 300,000 tonnes of hydrogen per year. The green hydrogen will be utilized together with recycled carbon dioxide to produce carbon-neutral eFuels, which are chemically equivalent to fuels used today and can therefore be dropped-in to existing engines without any modifications required. The green hydrogen and eFuels produced by the HIF Matagorda eFuels Facility will be able to convert approximately half a million cars to carbon neutral as early as 2027.

OpenAI: Advancing AI

OpenAI is an AI and research company. The company launched ChatGPT on Nov. 30, 2022. OpenAI is also responsible for creating DALL-E-2, a popular AI art generator, and Whisper, an automatic speech recognition system. The model has many functions in addition to answering simple questions. ChatGPT can compose essays, describe art in great detail, create AI art prompts, have philosophical conversations, and even code for you. ChatGPT runs on a language model architecture created by OpenAI called the Generative Pre-trained Transformer (GPT). Generative AI models of this type are trained on vast amounts of information from the internet, including websites, books, news articles, and more. ChatGPT is a sort of language model created to hold a conversation with the end user. The app has already hit 100mn monthly active users in a matter of months and is fast gaining global traction.

OpenAI CEO, Sam Altman adds, “GPT-4 is just one step toward OpenAI’s goal to eventually build Artificial General Intelligence, which is when AI crosses a powerful threshold which could be described as AI systems that are generally smarter than humans. The right way to think of the models that we create is a reasoning engine, not a fact database. They can also act as a fact database, but that’s not really what’s special about them – what we want them to do is something closer to the ability to reason, not to memorize.” Altman and his team hope “the model will become this reasoning engine over time,” he said, eventually being able to use the internet and its own deductive reasoning to separate fact from fiction. It is clear that the possibilities are endless and the race to make better AI models is only going to become more intense.

Unilever PLC: No more a staples company

Unilever is facing battles on multiple fronts from DTC start-ups to rising costs and changing customer preferences. Investing in digital fortitude is how Unilever is building resilience. Unilever CEO Alan Jope explains, “It’s worth saying that the digital transformation is changing every dimension of Unilever from consumers’ journeys to the radical convergence of media, content, and commerce, data-driven customer relationships and management of retail conditions using advanced technology to a supply chain that has twins of most of our factories now in the metaverse, and which uses a combination of real-time mapping, geolocation data, and artificial intelligence to help prevent deforestation. And digital tools that we’re using extensively in R&D are giving us new insights, they’re shortening project timetables and they’re significantly lowering the cost of experimentation. You might think of us as a Staples company that uses digital technology, and I don’t think that’s right anymore. We’re more like a digital company that happens to sell soap and ice cream.”

Nubank: Money Boxes

Nubank is changing the complete roster of banking businesses in terms of account opening and managing deposits. In 10 years, the company has 75mn customers in Brazil, Colombia, and Mexico and emerged as the 4th largest credit-card player in Brazil. In Sept2022 the company launched ‘Caixinhas’ or money boxes, which have changed how people save money. Typical savings accounts offered little differentiation and frequently cost consumers money over time due to inflation. The Caixinhas provide something simple and secure that retains the ease of use while being segmented by goals, such as a vacation or a car, and then offer recommended investment products to help clients achieve their goal with a yield, including everything from stocks to CDB, LCI, and LCA. Customers found the simplicity appealing—in its first week, more than 1.7 million customers created 2.25 million-plus Caixinhas.

During the third quarter of 2022, on the personal finance front, the company unveiled Nunos, a free relationship program that rewards all clients through missions connected to their financial journey through a gamified experience in the Nubank app. Cofounder Cristina Junqueira says, “The purpose is to have a program that goes beyond rewards, but that helps our customers progress in their financial journeys, celebrating small achievements.”

ABB: Integrating Renewables to Grid

One of the biggest problems with renewable energy is electricity needs to be used as it is generated, which is not always at the same time it is needed. Sustainable power will be key for data centres in 2023 and it will enable technologies such as battery energy storage systems (BESS), which are becoming more mainstream. BESS allow data centres to store renewable energy generated on-site (from solar PV panels or a wind turbine) to be used when it’s most needed. Add Artificial Intelligence to battery storage and operators can use data acquisition, prediction, simulation, and optimisation to automatically charge and discharge the battery to make it even more effective and efficient, and prolong its life cycle. BESS is also being hailed as a sustainable alternative to diesel gensets as currently, generators can’t be run on hydrogen. Planning ahead will be key, as longer lead times for battery storage systems should be expected with demand high.

Market Outlooks

Geopolitical conflicts, inflation-driven hikes in global interest rates, and worries about a potential recession marked the Financial Year 2023. This resulted in a correction in global equity markets of ~10%. Given the backdrop, flat equity market performance of the Indian equity markets is satisfactory although valuations have compressed due to the time-value of money. Going forward, we believe that the market’s focus will shift back from valuation multiples to earnings. While recessionary fears may lead to a decline in forecasted earnings, markets will once again draw the line between good and bad companies using one key factor: quality. We believe that quality stock picking shall continue to play a key role in investment performance, regardless of varying macroeconomic conditions. Our proactive management and emphasis on bottom-up analysis put us in a good position to benefit from this.

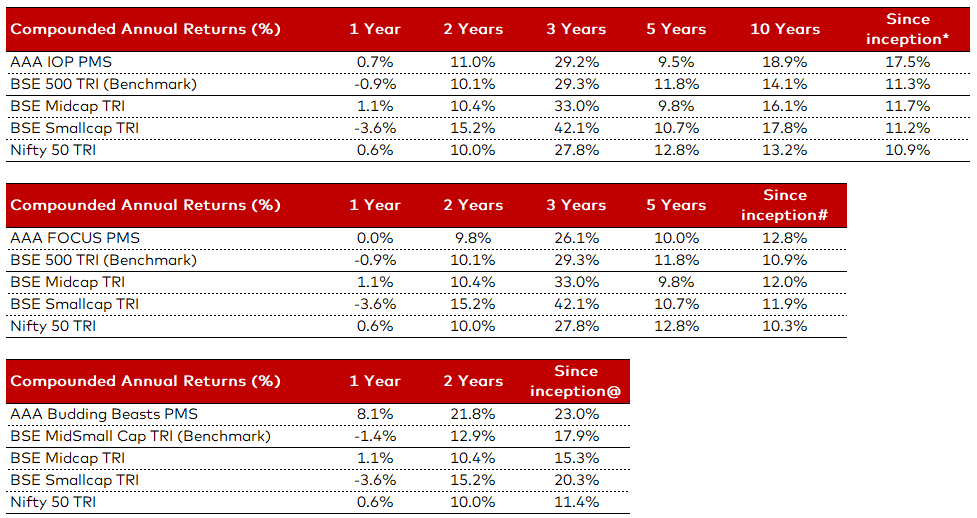

AAA PMS Performance