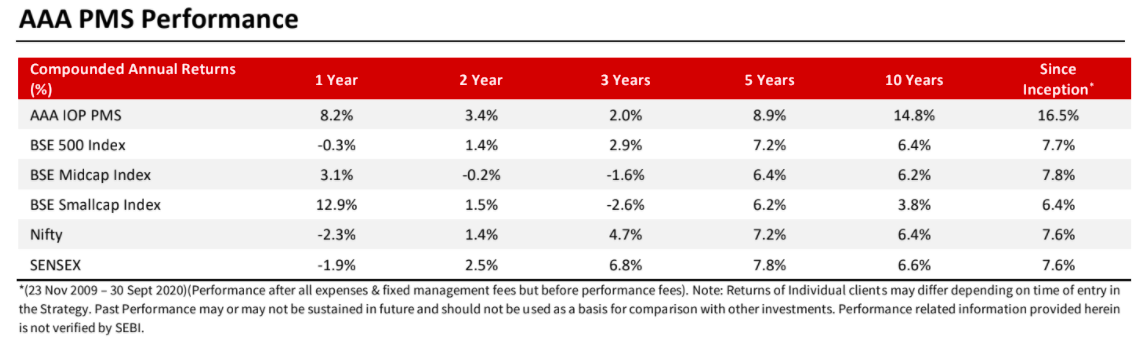

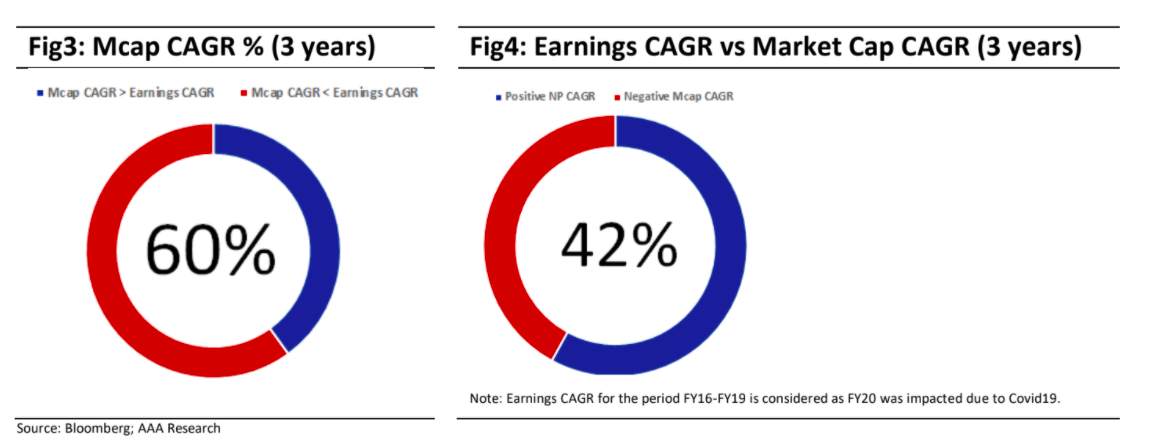

During Nov, Nifty recovered to pre Covid levels; it managed to cross its previous peak recorded in Jan 2020. Reduced cases of Covid19, strong earnings performance in 2QFY21 by corporate India, and record FII flows (USD9.6bn in Nov20) resulted in this sharp rise in the equity market. On traditional valuations parameters – PER and PBR, Nifty trades at a premium compared to its last ten years average, making Investors worried about market valuations. In this backdrop, we used simple but useful tools to gauge whether one needs to be cautious at current market levels or not. Here are our observations:

1. Polarisation to Normalisation

We wrote a detailed note about the strong case of Polarisation to Normalisation one year back in Oct 2019 (read ). Since then, many events have happened – things we never forecasted like Covid19, yet our thesis is proving right. During 12 months, Midcap and Smallcap Indices outperformed Nifty Index significantly despite Covid19 hitting hard on mid & small businesses. However, on a three-year basis, BSE Midcap and BSE Smallcap Indices returns are broadly flat compared to the Nifty return of 9.79%. Even within Nifty, a handful of stocks contributed to its gain while the Nifty Equal weight index delivered just 2.24%. As the market repositions itself for the normalisation of the economy, we expect the broader market to do well.

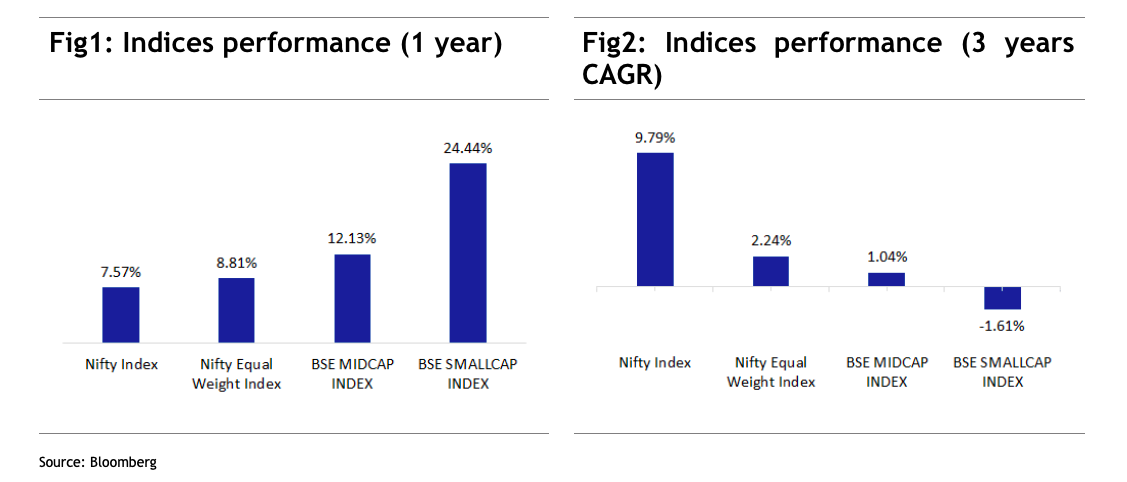

2. Earnings Growth vs Market Cap Growth

This is a powerful tool to check possible upside/downside scenarios as in the long term, market cap growth is a mirror of earnings growth. During the last 3 years, 274 companies i.e. ~60 % of BSE 500 universe stock price returns, are less than earnings growth. If one takes only positive earnings growth companies, 42% of the universe (191 companies) reported positive earnings growth but registered negative price returns. Ironically 116 companies registered 15%+ net profit CAGR, but market cap is yet to reach Nov 2017 levels. These observations further confirm good scope for broader market participation.

Market Outlook

Structural Reforms carried out by the Indian government like GST, RERA, The Insolvency and Bankruptcy Code impacted growth in the initial period. We believe temporary disruptions caused by many reforms are behind. Importantly, government policy action, mainly the PLI (production linked) scheme, is most potent to improve India’s manufacturing sector competitiveness. A lower tax rate and a lower cost of manufacturing have the potential to change corporate India’s earnings growth and ROE structurally. While benchmark index valuations have risen, broad market valuations are still reasonable, considering the strong growth runway that lies ahead for 2-3 years. Corrections are part of any bull market, and one should expect it along the way; we recommend investors to take that as an opportunity to add to the equity asset class.