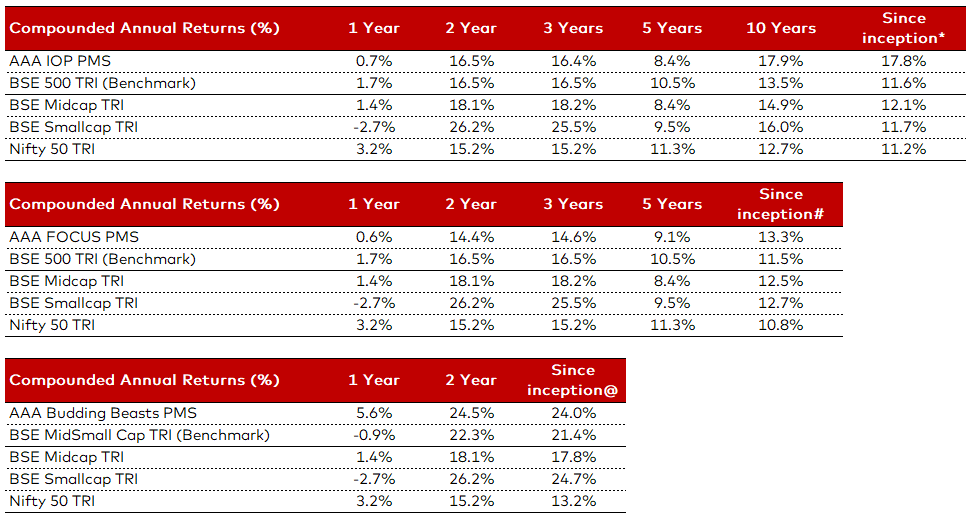

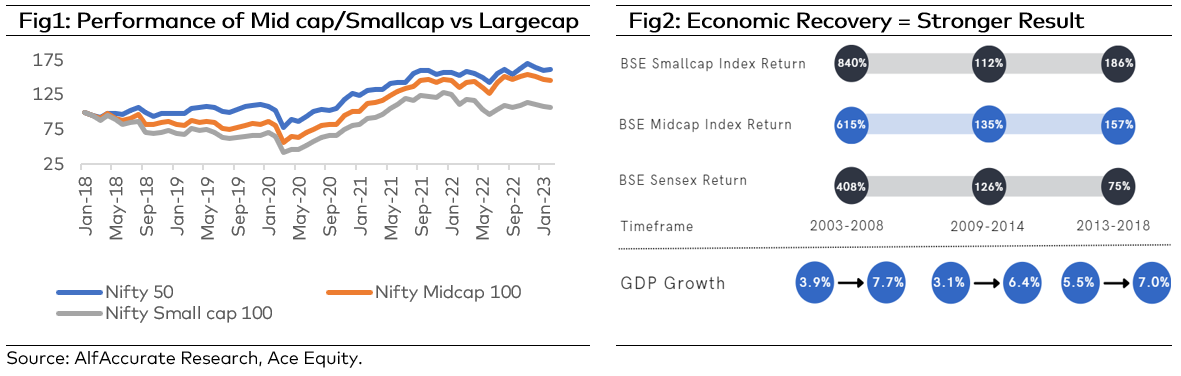

On both a one-year and five-year basis, India’s mid-cap and small-cap indices have significantly underperformed their large-cap counterparts (refer Fig1) as investors sought shelter during the difficult times. Focus is now on economic recovery and earnings growth as significant events of the Covid-19 pandemic, the Russia-Ukraine War, high inflation, and heightened rate hikes now appear to be behind us. We think the midcap and small-cap markets in India are budding beasts, well-positioned to deliver strong performance over the long term.

1) Economic recovery = stronger outperformance for mid/small cap:

Midcap and Smallcap stocks have historically been significant wealth creators during India’s three periods of rapid economic growth: 2003–08, 2009–14, and 2013–18 (refer Fig2). The relatively smaller size has enabled these businesses to move quickly, demonstrate rapid earnings growth, and demand greater multiples. The government’s emphasis on manufacturing, removing supply constraints, and relaxing rules and compliance are expected to help the Indian economy post a robust 11% GDP growth for FY24. Compared to the top 100 companies in the nation (based on market cap), the mid and small-cap companies have more potential to grow quickly in this favourable environment.

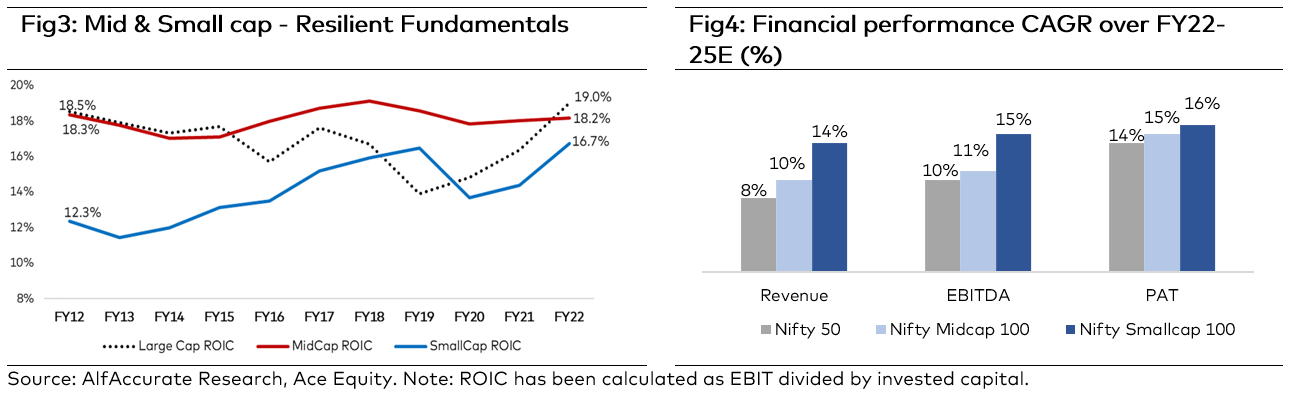

2) Improving Fundamentals:

Since FY12, the fundamentals of mid and small-cap companies have dramatically improved. Compared to large organisations, the ROIC of midcap companies is significantly more resilient. Small-cap ROIC has also significantly increased during the past ten years, rising from 12.3% to 16.7% over FY12 to FY22. As a result, there is now a much smaller difference between the ROIC of large cap corporations and that of mid- and small-cap enterprises (refer Fig3).

In terms of earnings growth, mid-cap and small-cap companies are projected to outperform large-cap companies given the economic recovery (refer Fig4). This supports a compelling argument that mid- and small-cap equities should be valued higher than their historical multiples.

Additionally, mid-cap and small-cap indices are more balanced and reflect the overall economy, in contrast to the Nifty index, which is substantially concentrated towards industries like banking and software.

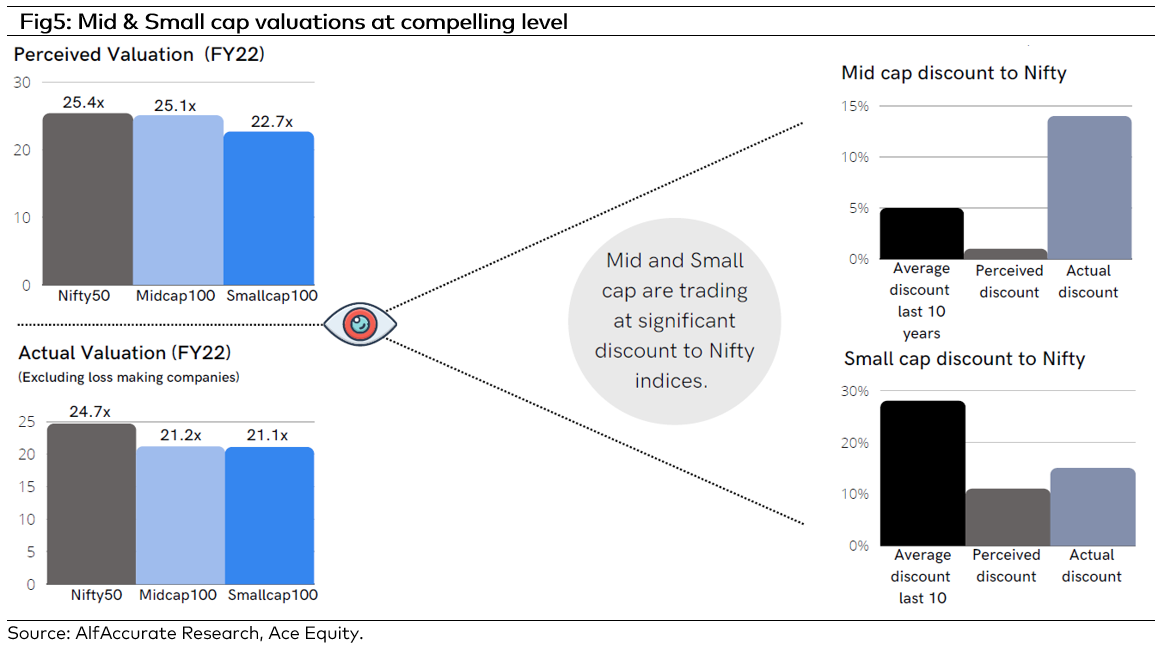

(For our analysis, we didn’t include the loss-making businesses in our research because they are typically not investible and skew assessments of earnings multiples across indices).

3) Valuations – Correcting the illusion:

We think that index headline valuations paint an inaccurate image. We eliminated loss-making companies since they distort the true multiples, making it difficult to correctly evaluate the values. After eliminating irregularities, we discovered that mid-cap and small-cap valuations are at a 15% discount to the large caps index rather than a near 0% discount as perceived by the market (refer Fig5).

What is more comforting is Midcap currently trades at PER of 16x FY24E, 14% discount compared to its last 10 years average PE of 18.7x. Small cap is also trading at an attractive valuation of 15.1x FY24E compared to 10 years’ average valuations of 14.3x.

Market Outlook

The finance minister continued to advocate for growth in the Union Budget 2023 while maintaining fiscal discipline. The overall quality of government spending continued to improve, with capex spending expected to account for 22% of total spending in FY24 BE, reaching a 19-year high. After a low base of 6% in FY23, it is projected that aggregate capex spending (including CPSE) will increase by 22.1% in FY24. Direct tax cuts bode well for reviving the consumer sector. In addition, despite being a pre-election budget, FM avoided populist policies. It is reasonable to make the general assumptions of nominal GDP growth of 10.5% and tax revenue increase of 10%. The market borrowings, with gross growth of 8.5% and net growth of 6.5%, are in line with expectations.

We are overweight in the consumer and capital goods industries, which will gain from this budget. Regarding value, the nifty trades at PER of 18x FY24E, keeping up with its average valuations for the previous ten years. With the worst of the inflation and interest rate issues behind us, we think that the current correction and consolidation present a favorable opportunity for investors to raise their allocation to the equity asset class over the course of the medium to long term.

AAA PMS Performance