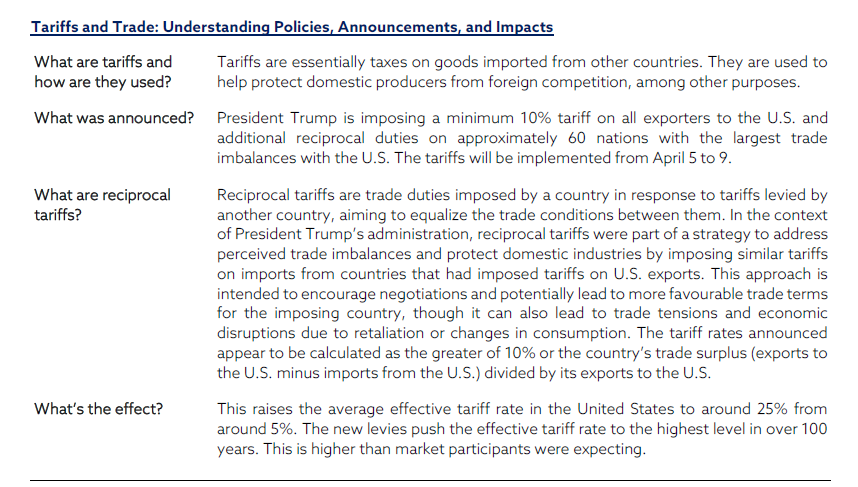

Major U.S. policy shifts have stoked uncertainty. In his bid to reduce trade deficit and Make America Great Again, Mr. Trump announced increased import tariffs followed up with reciprocal tariffs and then after the biggest four-day stock market rout in five years, he pulled back with pause for 90 days except his policy on China. His recent change in stance makes market to believe that Mr. Trump is flexible and that is sigh of relief for global markets. Net-net, as on now, US tariffs on steel, aluminium and automobiles remain at their current rates. Tariffs of 10% on all countries (except China where it is 125%) or 25% on Canadian and Mexico goods, with the exception of items covered by the North American trade pact, will also stay the same and EU imports to also face 10% tax.

Impact on tariff on India:

India remains a domestic oriented economy with consumption accounting for ~60% of total GDP. On the other hand, merchandise exports accounted for only 12% of GDP in FY24. Assuming a 10% decline in value of India’s exports to the US, the total impact on India’s GDP growth is likely to be ~0.2%. However, lower rates on pharma products and the possibility of a trade agreement can limit this impact. Further, there is also an opportunity for India’s exporters to gain market share from other South-East Asian countries, in which case these tariffs could be marginally positive for India.

Prima facie, the sectors which are likely to be impacted most are precious stones, auto component and machinery besides readymade garments. Further, since these sectors have a high concentration of MSMEs, the sector may face increased challenges, requiring possible government support. The government may be expected to come out with special schemes to buffer this impact. Recession in USA can adversely impact India’s service exports to USA.

Profitability of companies in these sectors would need to be monitored as they can get affected due to export turnover coming down or prices being reduced to maintain competitive edge. This is something which banks would also need to monitor given their exposures to these sectors.

Investment playbook:

India vs other Markets

India has lower dependence on USA exports which offers natural advantage of lowest adverse impact on its economy. USA has significant higher deficit with China and Vietnam and hence, high possibility of US imposing higher tariffs on these countries compared to India. That gives India a unique opportunity to take advantage to improve its market share on global map in categories like textile and electronics.

Domestic driven sectors to perform better

In such macro uncertain environment, domestic linked sectors like healthcare, consumer, banking are likely to perform better. For sectors which are globally linked there is a possibility of second level impact on sectors which are linked to USA economy. Hence fear of recession can adversely impact the growth prospects for sectors like IT, metal, textile.

Multiple defenders needed to cushion portfolios from shocks

In such uncertain environment, diversification across sectors and companies enables portfolio to insulate itself from volatility and sharp drawdown.

Active management to separate winners and losers

Companies and sectors will be impacted unevenly. Companies that are domestically oriented, services-oriented and have higher pricing power are likely to fare better. Companies that have large profit size will be more resilient compared to smaller profit size.

AAA portfolio positioning

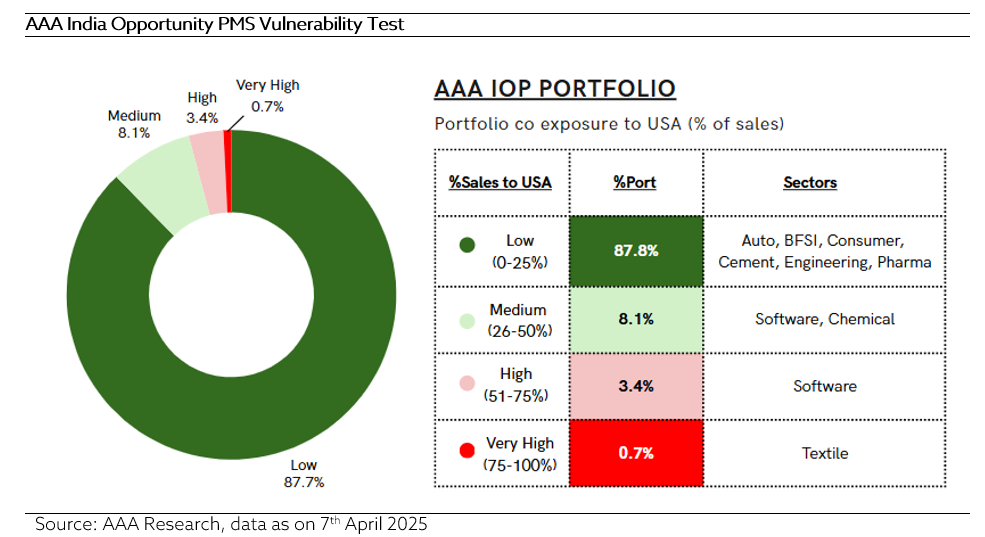

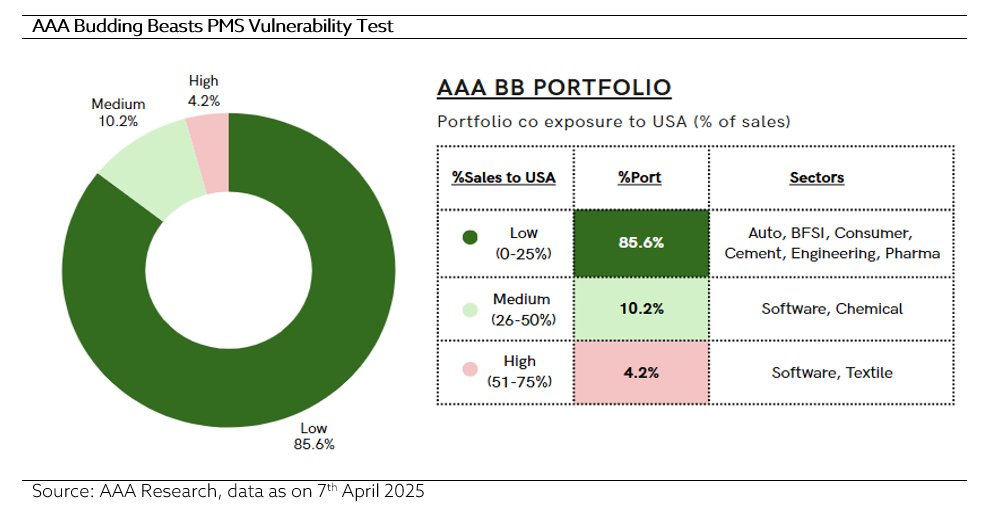

AAA IOP and AAABB, both the portfolios have low exposure to USA (defined as portfolio company’s revenue as percentage of sales in USA) (refer below charts) and hence less vulnerable to any major slowdown in USA economy.

Market outlook

We expect market to continue to remain volatile. Nifty earnings to be impacted much lesser as only ~22% of Nifty earnings are linked to Global economy; hence, we expect Nifty earnings growth for FY26 to remain strong ~10%+ depending upon the outcome of final tariffs. Nifty valuations at ~19x price to earnings multiple on FY26E is near to its long term 10 years average, which provides good entry point for long term investors. Historically, maximum point of uncertainty has also resulted in maximum point of returns. Hence, we recommend investors, to remain calm and possibly use volatility to their advantage by adding to equity asset class.

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

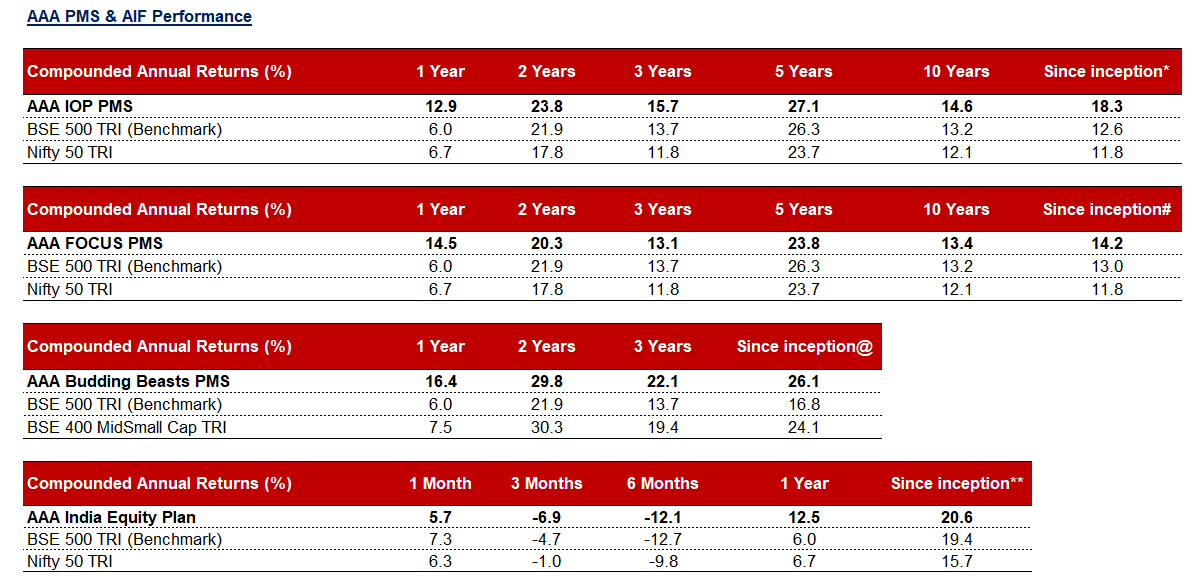

*(23 Nov 2009 – 31 Mar 2025); #(17 Nov 2014 – 31 Mar 2025); @(01 Jan 2021 – 31 Mar 2025); **(16 May 2023 – 31 Mar 2025)

Performance is after all expenses and fees. For AAA IOP, prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines. For AAA India Equity Fund, the performance is calculated based on pre-tax NAV for share class A1 as on last Friday of the month.

Note: Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI. For AAA PMS, returns of Individual clients may differ depending on the time of entry in the strategy.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.