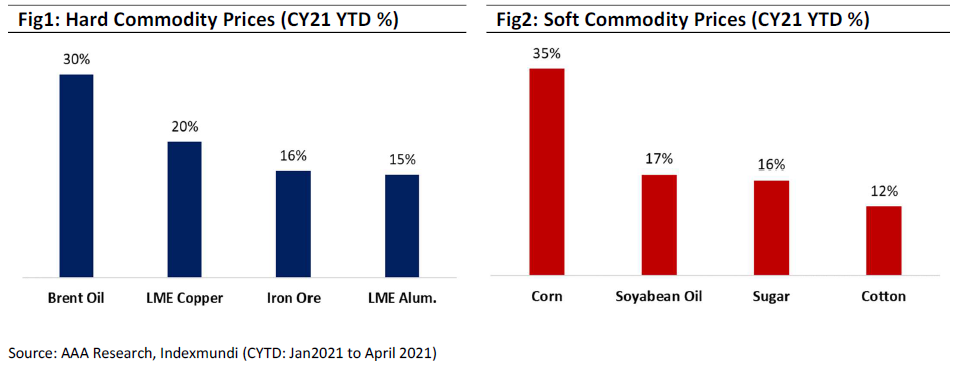

As the world is still recovering from the pandemic shock, Corporate India has faced another problem with rising global commodity prices. Today, several commodities are trading near their lifetime highs amid the faster economic recovery in some developed countries such as the USA and China (Refer Fig1 and Fig2). In this newsletter, we try to decode how did we land up here and the implications for the equity market.

How did we reach here?

Last March, as the world economy shut down, commodity producers knew they were in for a difficult time. Demand fell off a cliff, and producers scrambled to cut capacity. Mines shut shop, rolling mills ground to a halt, and oil transporters had to pay buyers to take delivery (negative WTI crude). Both the producers and customers saw a simultaneous shutdown in the capacity. With no sign of demand returning, producers scrambled to cut costs.

What surprised the markets was the quick resumption in business activity post lockdowns. By June 2020, industrial units were up and running, and with lower supply, they began to run down inventory. At the same time, the fiscal policy response to the pandemic was more potent than the 2008 response after the Lehman crisis. The USA has promised to spend $5.4 trillion, with a large part of it going for infrastructure spending. Hence demand stayed while supply continued to languish. To add to its woes, stringent environmental norms by China resulting in a cut in capacity and logistic issues (container shortage, labour shortage, etc.) further disturbed the timely availability of material. According to recent data published by Institute for Supply Management (ISM), longer lead times are one of the clearest indications of producers’ supply-chain challenges. Wait times of factories for production materials grew to 79 days in April, the longest in records dating back to 1987 (refer Fig 3). This resulted in a sharp increase in the global commodity index (CRB index) to 552 levels reaching near to its peak of 2011 levels (refer Fig 4).

Commodity price volatility to persist

The global economies are still going through the lock-unlock-lock phases due to the Covid19 pandemic. During such an uncertain time, in countries where restrictions on mobility are lifted, demand picks up suddenly, causing an imbalance with supply. When value chains are long and complex, supply takes more time to react. Uneven demand patterns are driving firms towards a scramble for inputs to protect against future shortages, exacerbating supply shortages. Just in time, inventories are being forsaken. Stocks of finished goods are below normal globally, and some normalization here will be a signal for easing supply-side pressures.

Equity market strategy: Resilience is a key

Global inflation uncertainties make investors nervous. With investors worried, US Federal Reserve officials restated their dovish monetary policy stance, playing down rising inflation and concerns about tightening of easy monetary policy, providing some assurance.

In such high and volatile inflation time, companies with market leadership and a strong balance sheet are far better positioned in such volatile times due to 1. better raw material availability, 2. high bargaining power with suppliers, and 3. superior pricing power to pass on the cost inflation to the customer. AlfAccurate portfolio consists of companies that are leaders in their sectors – backed by our 3M (market size, market share, margin of safety) stock selection approach – with an underleveraged balance sheet. Such companies have historically gained market share and delivered resilient earnings growth through the business cycles.

Within our 3M Investment framework, we identified three megatrends since May 2020 – Acceleration of formalisation, China + 1, and Automation & Innovation and they are playing out well (Refer Key Investment Themes to Capitalize on the Covid-19 Crisis).

The second wave of a pandemic and commodity surge will impact unorganised players hard, which already got impacted severally during the first wave of the pandemic. This will further accelerate the formalisation of the economy and will benefit the leaders of the sector significantly.

More robust USA economic recovery further gives our China + 1 basket of portfolio companies impetus, particularly in sectors like auto ancillary, specialty chemical, and engineering sectors as they have significant export revenue and are witnessing healthy demand trends from global customers.

During the last 12 months, leading Indian companies have increased focus on automation and innovation to improve efficiencies and reduce dependence on labour. One of the leading suppliers of robotics and automation – has witnessed healthy growth in its order intake during 4QFY21, confirming rising adoption of automation.

We believe our portfolio companies will continue to benefit from megatrends and climb over the short-term Inflation worries.

Key Risks: National lockdown, severe Covid third wave, slower vaccination drive.

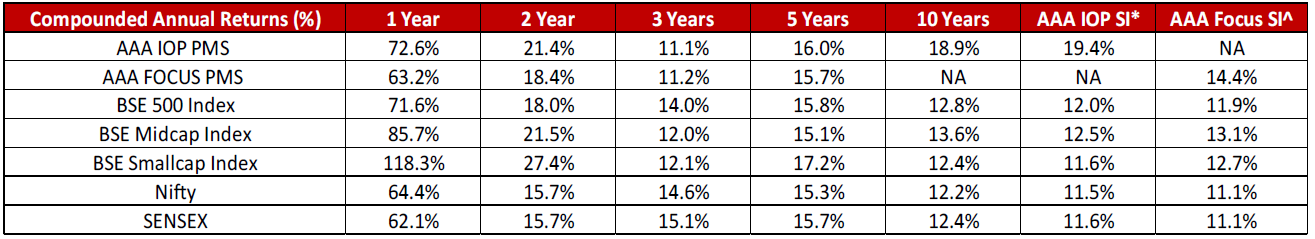

AAA PMS Performance