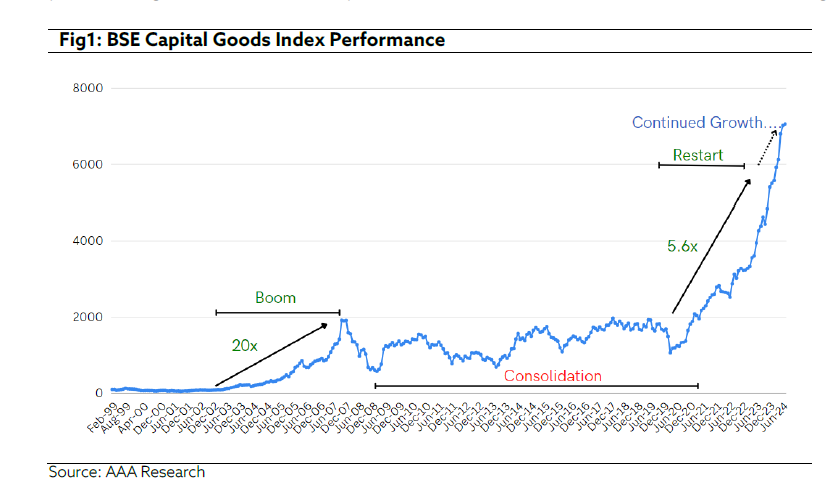

Capital Goods is a deeply cyclical sector. If identified timely, capital goods companies have a potential to generate outsized multi-decadal returns. For instance, the BSE Capital Goods Index appreciated by a whopping 2000% from 2002 – 2007, vs Sensex which appreciated 500%. At AAA, we identified the capex theme in 2021 (watch our 2023 webinar) and increased our allocation to the sector significantly across all our strategies. It’s been three years, during which the sector is up more than three-fold as seen in the chart below in Fig1.

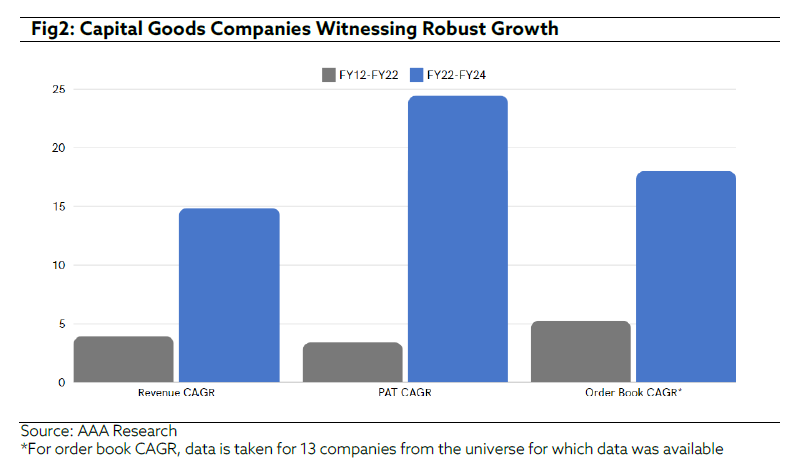

After a harsh winter of almost a decade until 2021, the Cap Goods universe witnessed a substantial increase in revenue, operating profit and most importantly, the number of order inquiries as seen in Fig2.

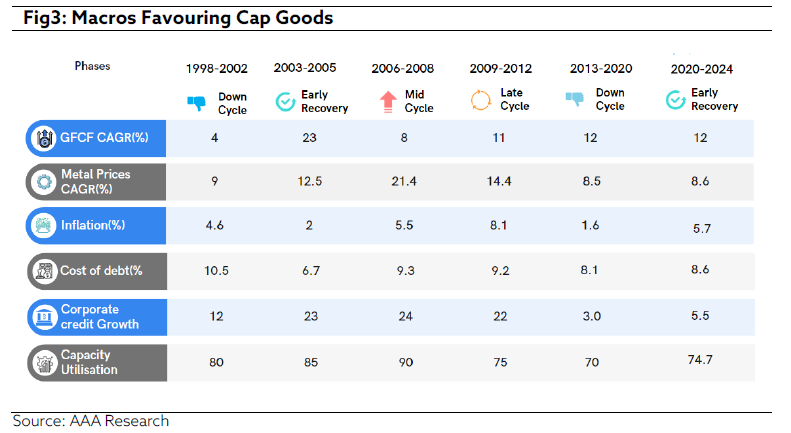

We continue to be bullish on the sector. On the macro front, GFCF has witnessed a 12% CAGR over the past 4 years. The annualised price growth of metals at 8.6% is also supportive. While the interest rate is steady, it has a room to reduce, providing scope to further accelerate the cycle. The government steadily kept bumping up capex, while the private sector capex cycle also seems to have reached the inflection point. Increasing in capacity utilisation, along with continued incentive to Make in India is likely to result in an improvement in the private sector capex. In FY24, listed corporate capex registered a strong growth of 18%, highest in last decade. We expect this number to improve further. Key infra sectors such as power, cement, refining are near peak capacity utilisation rates, which indicates the importance of an imminent increase in capex. Cumulatively, all these signs make us believe that the cycle is currently under early recovery (refer Fig3), which makes it conducive for the cycle to continue over the next few years.

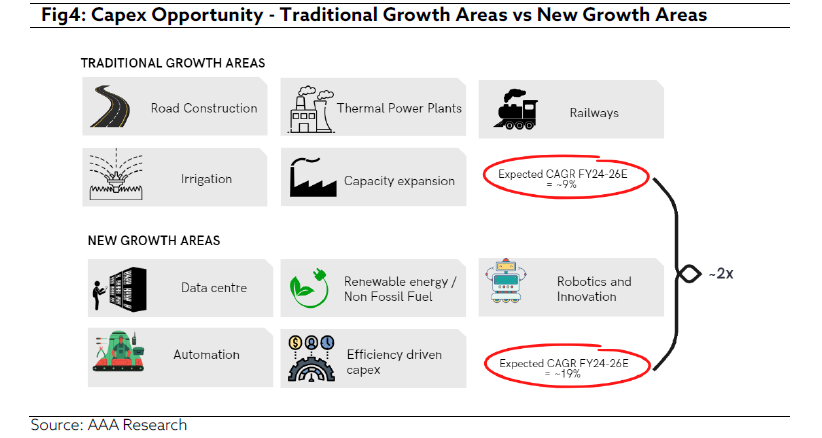

There are two ways to capitalise on the capex theme. The first one is playing through traditional drivers like road, construction, EPC, and irrigation. The second way is to play through the new emerging business drivers such as cutting-edge technology, big data, product innovation. The new business drivers have a much greater delta potential than traditional growth areas as outlined in the picture below.

In this newsletter, we throw some light on the future opportunities which can continue to facilitate tailwinds for such companies.

Renewable Energy

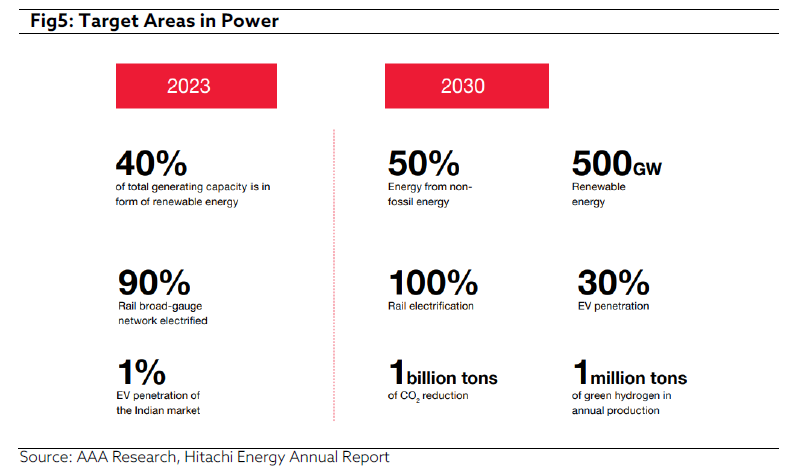

In the past couple of years, the government has achieved many milestones in India’s energy journey through their persistent focus on decarbonization and power reforms. Some historic reforms include capacity building for renewable energy sources, renewable manufacturing boost, electric mobility, coal gasification, and the also the National Green Hydrogen Mission. This will completely change the energy landscape of the coming decade, as evident from figure 3.

Working towards the goal of achieving non-fossil fuel-based electricity, Inter-regional Transmission Capacity has zoomed from 27,150 MW in FY12 to 1,12,340 MW in FY24. This number is further expected to expand by 31,510 MW over the next 3 years. The biggest beneficiaries of this trend will be product companies which are at forefront of technology.

Data centers

Evolution of AI has fast-tracked the demand for IT infrastructure because of increased adoption of cloud services and digital transformation. With more and more consumers and businesses using Data Center and cloud services, the demand for hyper scalable Data Centers is booming, with capacity expected to grow at a ~40% CAGR over the next five years. Data Centers need constant power supply, effective cooling and uninterrupted network service to function efficiently and provide 99.99%+ uptime, making them another significant demand driver for electricity.

Defence

India is now the world’s 3rd largest defence spender as of 2022 from being the 9th largest defence spender in 2000. This number is further expected to grow two-fold over the coming years. The icing on the cake is the government’s focus on building country-to-country relations to promote exports. In fact, over the past eight years, defence exports as a % of the domestic defence spend has jumped from 7% in FY15 to ~18% in FY23.

Moreover, the ratio of imported capital procurement for defence has reduced from 57% in FY14 to 32% in FY24. This is in line with Modi regime’s original intent to reduce defence imports from 70% to 30%. The government has achieved this by encouraging domestic manufacturing and promoting exports. Global geo-political tensions and India’s rising focus on self-reliance continue to fuel order flow and revenue growth for domestic defence companies. We expect this sector is poised to keep delivering good earnings growth over the next couple of years.

AAA Positioning

Currently, our entire portfolio is tilted towards companies that are at the forefront of innovation, backed by technology. These companies face limited competition, and many a times, they compete with global peers, which not only lead to better margins, but also the facilitation of an annuity service revenue. Many of these companies are subsidiaries of large multinational parent cos. Simultaneously, on the lateral side, we have observed increasing interest from parent cos on transitioning their Indian arms and make them a hub to cater to their global requirements.

Kindly note that the companies mentioned are not our recommendations and we may choose to reduce/exit any of our holdings based on our internal portfolio strategic decisions.

Market Outlook

We remain positive on the markets. With election related uncertainty behind us and the return of the Modi-led NDA government, we expect continuity of the policy. We expect sustained focus on capex, infrastructure, manufacturing, thrust on self-reliance. The extra windfall from the RBI dividend as well as strong growth in tax collection, can be utilised by the government to revive the rural economy and provide relief to the mass middle class of the economy. Corporate India has registered 18% earnings growth for the 4th consecutive year in FY24 – first time after 2006 and we expect Nifty to continue to deliver 12-14% earnings growth in FY25 and FY26. Trading at 22x P/E on FY25, the valuations seem to be reasonable considering the last 10 years average P/E of 21x.

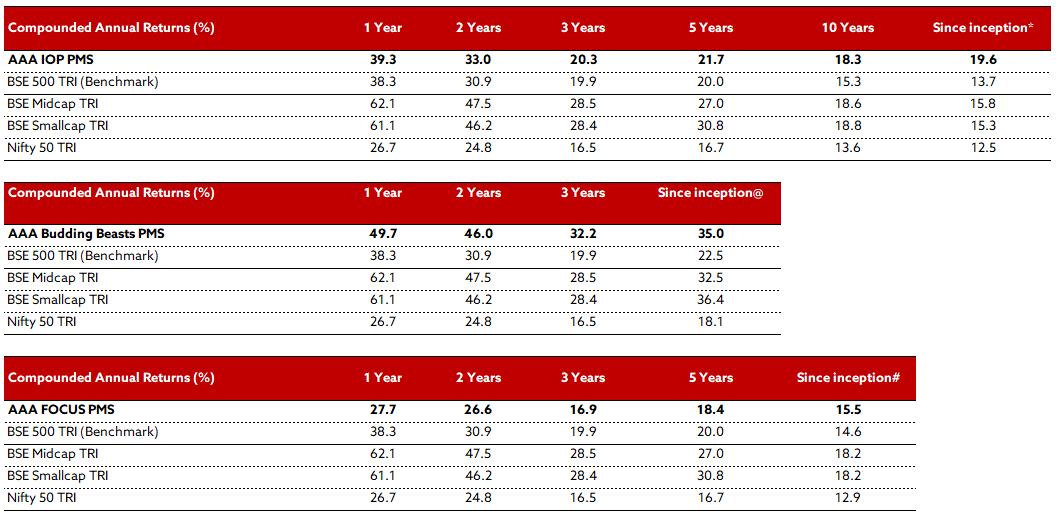

AAA PMS Performance

*(23 Nov 2009 – 30 June 2024); @(01 Jan 2021 – 30 June 2024); #(17 Nov 2014 – 30 June 2024)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.