Markets are noisy. Together, US federal government shutdown fears, Fed hawkishness, and lingering inflation have led to increasing fear in the minds of investors. In India too, many have been worrying about the small and midcap stocks runup. During such periods, emotional regulation is imperative. It’s easy to get overly focused on the short-term market narratives and become impatient. Often times, investors lose sight of the bigger picture and let the external noise get into their heads. However, sometimes it’s important to have a bird’s eye view. In this newsletter, we evaluate the underlying trends of Corporate India, and their influence on the markets.

Decoding Market Fundamentals

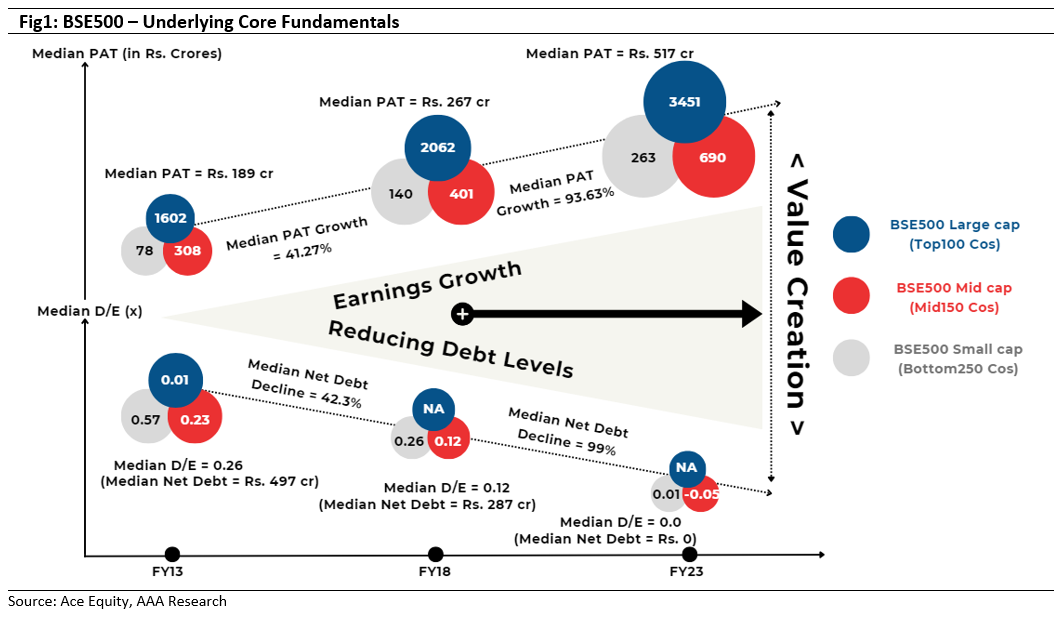

Over the past decade, corporate India has undergone a transformation, with notable structural changes such as the implementation of GST, the creation of digital infrastructure, and the government’s focus on Make in India initiative. To understand the numerical effect of these on corporate India, we analysed the profit size, and leverage levels of the BSE 500 universe over the past decade. To holistically assess the underlying strength, we evaluated the impact on each market cap category by dissecting BSE500 Index into three buckets (refer Fig1): Large cap (the top 100 companies: 1-100), Mid cap (the middle 150 companies:100 – 250), and Small cap (the remaining 250 companies: 250 – 500).

As evident below, the median net profit size of BSE 500 companies has almost tripled over the last 10 years. Interestingly, the growth in the second half of the decade has accelerated, spurred by a number of catalysts as outlined above. Diving further, the median PAT growth for Small caps has outpaced the median PAT growth for the other two categories. This implies that 50% of the index constituents towards the tail end contributed greatly to the overall growth. More importantly, this profit growth was complemented by a decline in leverage, marking a commendable feat achieved by corporate India, despite the hurdles faced during the pandemic in FY21, and geopolitical issues in FY22. Affirmatively, the small cap bucket has again outshined the other two, with sharper declines in debt levels. This shows the robust fundamentals of small caps, and how they’ve become more resilient, thereby bridging the gap with their peers.

Going forward, the outlook for corporate profitability seems bright because both consumption and capex are increasing in the right direction. Housing (Public), infrastructure (Government), and corporate capex (Private) capex in India are all experiencing an upcycle. Residential sales in the Top-7 cities have increased by a staggering 40–50% over pre–Covid levels, breaking out of a protracted downturn of around 7-8 years. Over FY19-FY24E, the central government’s capital expenditure as a percentage of GDP has doubled to 3.3%. With further upside likely from PLI incentives, data centres etc, the capex cycle appears to be durable.

This rapid growth of Corporate India is also propelling the disposable incomes of the middle class, which accounts for a third of India’s population. Consumption trends are thus shifting towards premium discretionary spends, showing resiliency even during inflationary times. Consequently, demand for bigger cars, jewellery, branded apparels and electronic gadgets is increasing and seems poised to grow over the coming years.

Bottomline

Cumulatively, the numbers narrate a positive story for the investors. Exceedingly increasing profits, combined with reduced debt and high ROE support the thesis of a higher valuation commanded by the markets on a broader basis as outlined in our July’s newsletter.

With that being said, we would like to reemphasise on the significance of quality as a crucial parameter for successful investment outcomes. As evident from above, low leverage, and high earnings growth formed the building blocks of the BSE500 index appreciation. Hence, quality should be a mandatory prefix to any investment decision. Sticking to quality will not only prove to be rewarding but also help in capital protection during market dislocations.

At AAA, our guardrails allow us to stay focused on great companies that we believe are competitively advantaged and have long runways for profitable growth for the foreseeable future. They also help us avoid getting distracted by fads or economic cycles. We focus on companies where the odds are in our favour and where we believe the opportunity to create wealth is sizable. By diving deep into different businesses and conducting extensive due diligence, we not only ensure the presence of investment quality in our portfolio but also its durability.

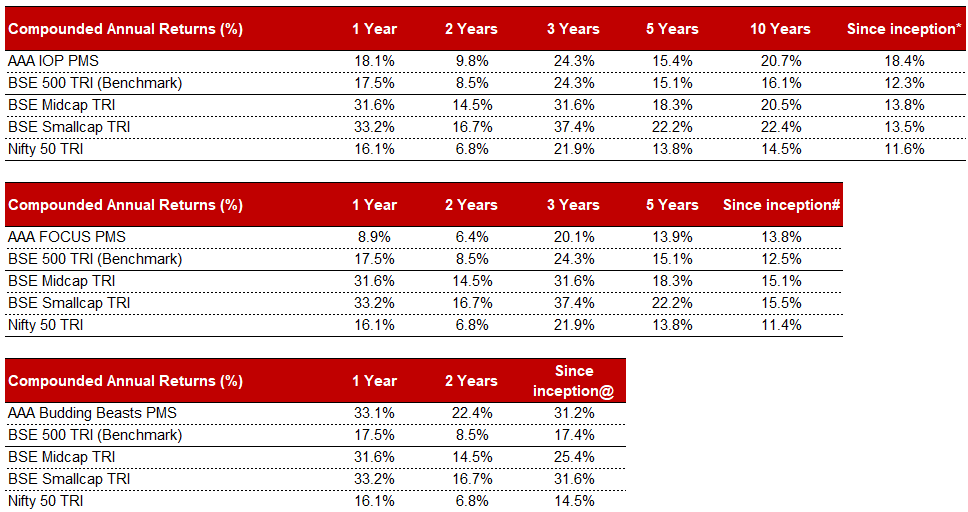

AAA PMS Performance