2021 was a winning year for Indian equity investors as Nifty rallied by ~24%, outperforming most emerging markets. Corporate India delivered robust earnings growth despite a severe second wave of pandemic and supply chain bottlenecks. As we head into 2022, the biggest positive is corporate earnings growth should be above the trend while the negative is increasing inflation pressure and rising interest rates. We at AAA still see opportunities across sectors and remain committed to delivering superior risk-adjusted returns.

Three Investment Mantras for 2022:

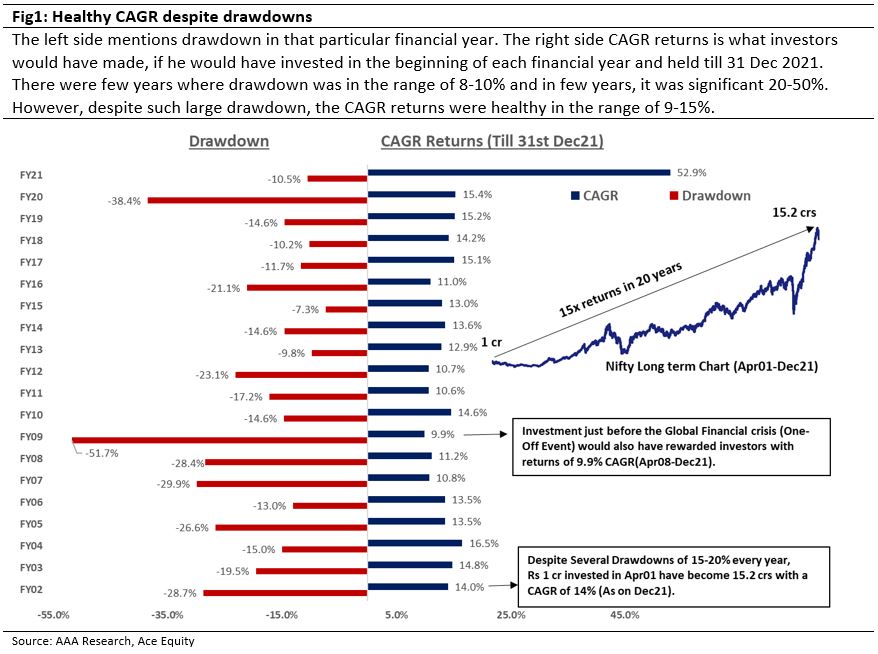

1. Equity Market to continue to outperform other asset classes

According to IMF, the Indian economy is expected to grow at 8.5% in CY22, highest in the world. Faster digitalisation of the economy, China +1 policy by global players, PLI (Production linked incentive scheme) along with several other reforms initiated by the government of India will make India’s economy USD5tn over next the 3-5 years. The journey to USD5tn GDP will generate huge opportunities for companies across sectors and will result in strong corporate earnings growth compared to the last 10 years. The solid earnings growth combined with the increasing ROE is a catalyst for strong equity market returns compared to other asset classes. While many investors get worried about volatility and bumps (corrections) in the market, the equity asset class has historically delivered strong returns – 15x FY02-Dec21 (ref Fig1) and we believe it will continue to do so.

2. Bottom-up approach will be more rewarding compared to Top-down approach

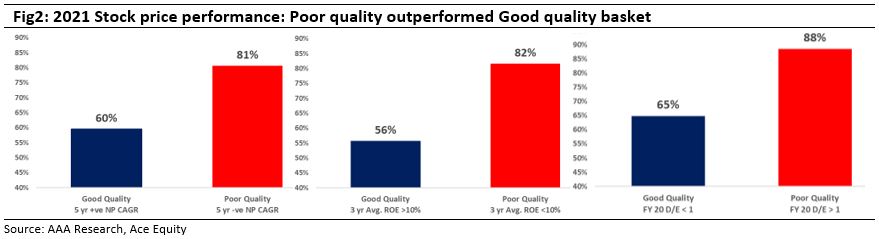

While we believe this market cycle is still in its early stages, the earnings growth in FY23 will be moderate compared to FY22 levels which were aided by a low base due to pandemic. As per Bloomberg consensus, Nifty is likely to report EPS growth of 34% (FY22) and 14% (FY23). While supply-chain and related inflation headwinds could linger into the first half of 2022, we expect both to ease after midyear. In such an environment, stock selection will be increasingly important in driving equity returns in the year ahead. This was not the case in 2021 as the year witnessed poor quality companies outperforming high-quality stocks (ref Fig2). In particular, we believe that the outlook for 2022 presents an attractive opportunity for an equity portfolio exposed to high-quality growth companies combined with an exclusive group of cyclical stocks. The former group continues to be a strong foundation for portfolios, due to the very attractive combination of strong balance sheets and significant earnings growth. Meanwhile, cyclical stocks will continue to benefit as the economic cycle expands and earnings expectations rise. Indeed, select industrials, although typically cyclical, may offer unique earnings growth prospects as they leverage technology to drive earnings. As we enter 2022, we have built the portfolio with companies that are market leaders with lean (unleveraged) balance sheet. These companies are gaining market share, reinvesting into their business, and are expected to deliver strong earnings over the next 2-3 years.

3. Harness active management

In the coming years, we expect volatility to rise as the global economic cycle transitions from the post-pandemic recovery phase to a normalisation phase. As a result, investors will continue to rely on the dynamic, risk management approach that remains at the core of AAA’s DNA, helping us maintain our commitment to both preserving and growing our clients’ wealth in challenging market conditions just as in bullish times. In 2020, we sought to shield investor portfolios from uncertainties surrounding pandemics in early 2020. Towards the end of 2020 and early 2021, as these uncertainties faded, we reduced weight in defensives like consumer and healthcare and increased weight in consumer discretionary and industrials. We expect 2022 to require similar agility and our investment team remains nimble with a close eye on business cycles.

Key Risks: Severe Covid third wave, significant increase in crude oil prices, geopolitical risks.

AAA PMS Performance