It is worthwhile to consider a Halloween landmark for markets as the world cleans up from this year’s night of extravagant costumes and way too much candy. Halloween 2007 marked a pre-GFC peak for the global markets. They dropped the next day, mostly as a result of an announcement that Citigroup Inc. could have to cut its dividend.

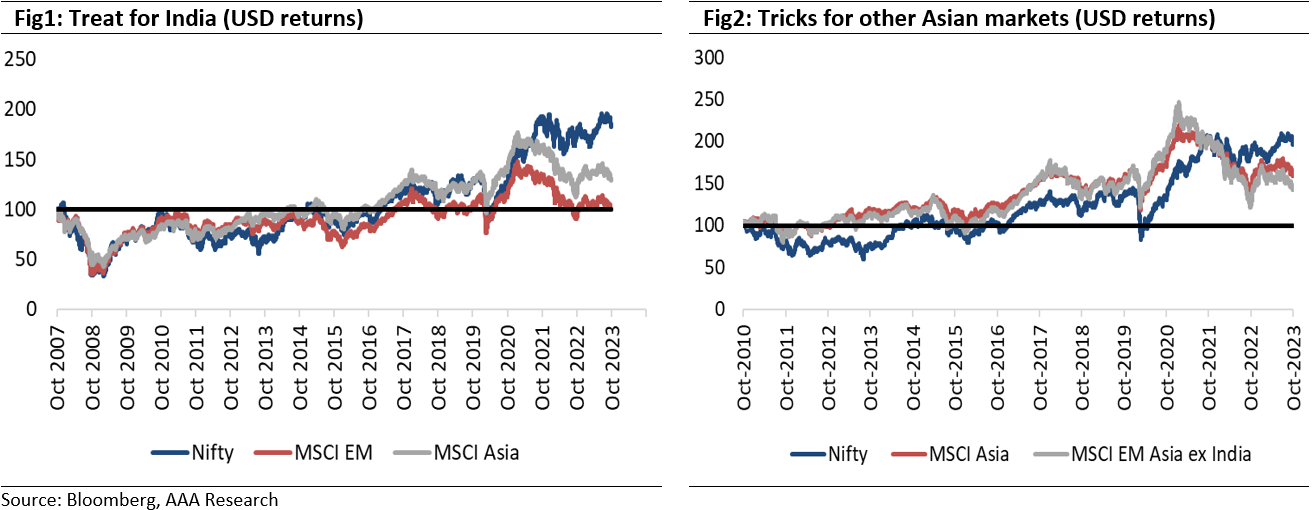

Using MSCI indexes, this is the 16th Halloween in succession that the Indian equity market has closed higher than on the witching night in 2007. The Indian market in USD terms registered a gain of ~92% compared to the MSCI Asia Index gain of 40% and MSCI Emerging Market gain of just 6%. If one takes the period since 2010, India is a shining star and compared to almost flat returns of all other Asian markets, India stocks almost tripled in INR terms and doubled in dollar terms. Indians keep getting all the treats, thanks to structural reforms done by the governments. This is reflected in India’s earnings per share which increased by almost fourfold over the last 16 years. The next decade belongs to India and when we think about how these charts might look in another dozen Halloweens from now, it is hard not to be surprised with continued good performance from Indian markets. But then the immediate question in the mind of investors is whether state elections will Trick the market.

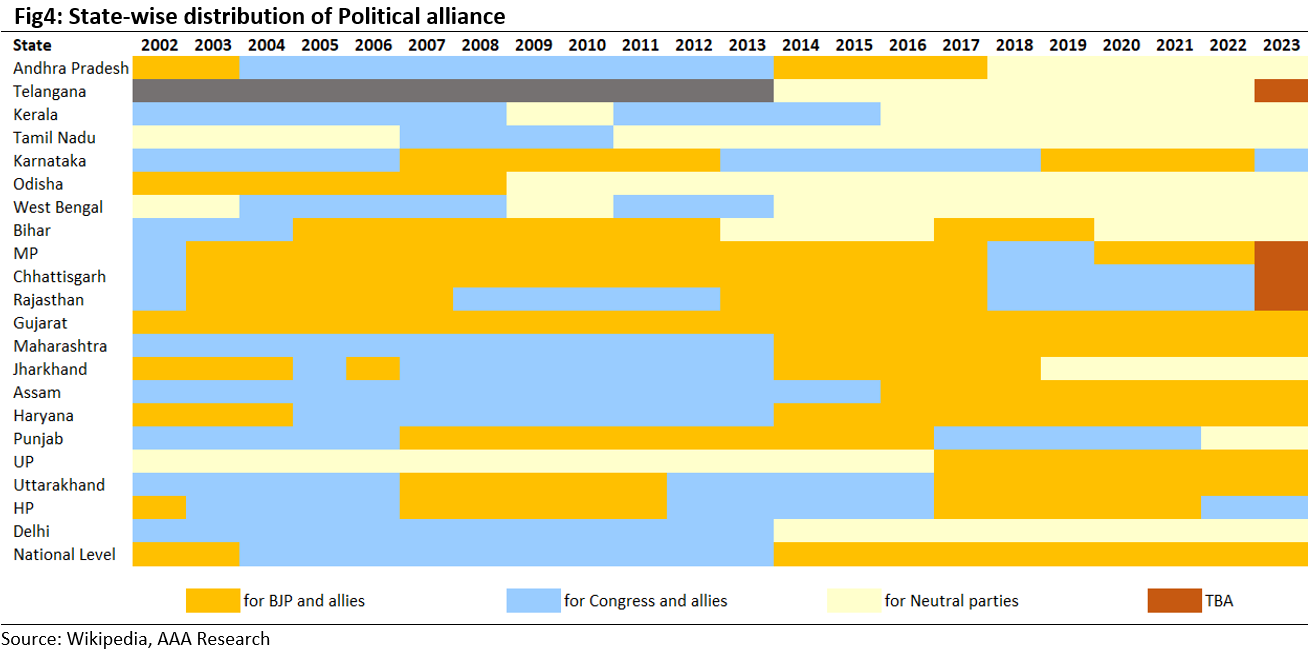

The election season begins with five states – Madhya Pradesh (MP), Rajasthan, Chhattisgarh, Telangana, and Mizoram entering the election period in November 2023. Together it accounts for 83 Lok Sabha seats. While market pundits are busy forecasting the outcome of the election and its likely impact on the equity markets, we present here a brief of how markets behaved in the past 20 years:

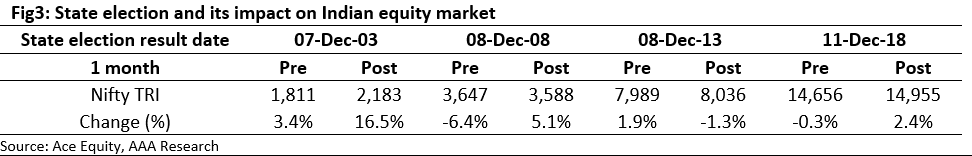

In 2003 and 2008, BJP+ won three important state elections (MP, Rajasthan, Chhattisgarh) but failed to win the central election. In the 2013 state elections, the then ruling parting in central government, Congress, and its allies, lost these three states and lost the central election, too. During the 2018 period, contrary to street expectations, BJP and its allies lost all three major central states of Rajasthan, Madhya Pradesh (MP), and Chhattisgarh, however, during the central election in 2019, BJP swept all three states. Except in 2003 when post-election Nifty witnessed a sharp rally of ~16.7% (one month post state election outcome), in all other three state election periods, Nifty remained in a range bound, which implies no impact on the market despite in-line as well as contrary state election outcomes (refer Fig 3). Lessons for politicians is that Indian voters is quite smarter and have started looking beyond caste and religion-based politics. The right governance is the only way forward for getting re-elected. The lesson for investors is that the outcome of state and central elections is not necessarily the same and predicting the market and making decisions in asset allocation based upon such events is not rewarding in the long term.

Conclusion:

Domestic factors continue to keep India in a bright spot, with robust tax collections, strong credit growth, and a manageable current account deficit as the main contributors. Q2FY24 earnings season so far is in line with expectations, with cyclicals driving profit growth, while defensives lag. We maintain a positive outlook at current valuations.

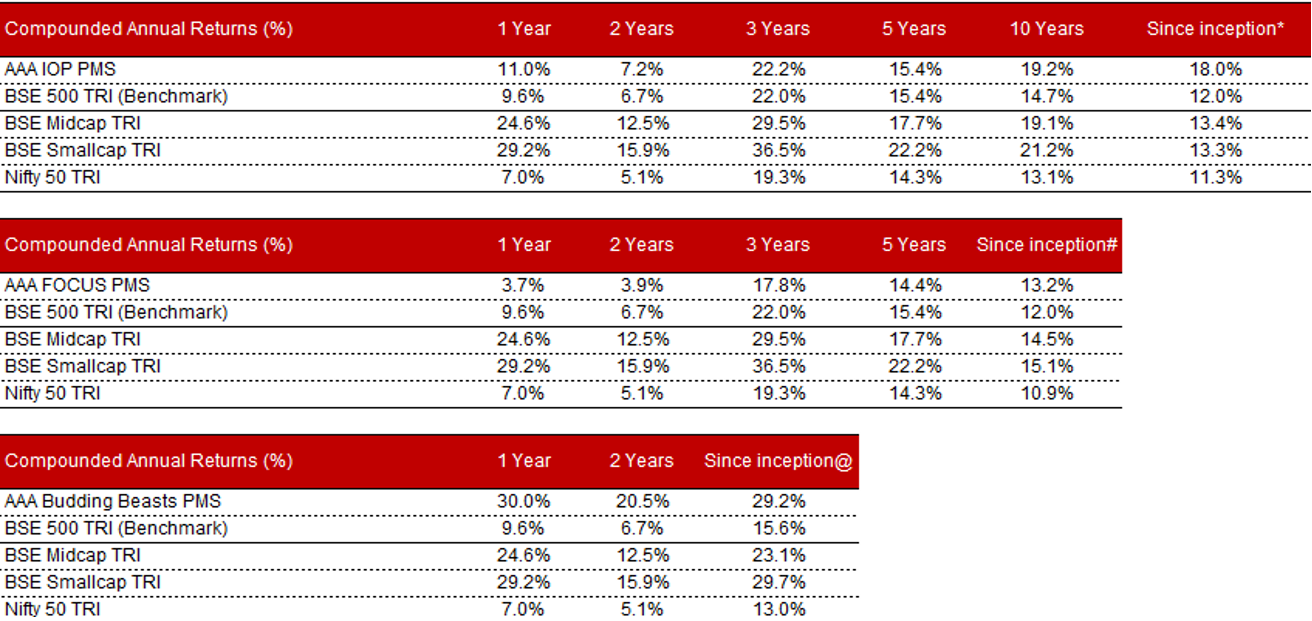

AAA PMS Performance

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

*(23 Nov 2009 – 31 Oct 2023); #(17 Nov 2014 – 31 Oct 2023); @(01 Jan 2021 – 31 Oct 2023)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.