“Your success as an investor will be determined by how you respond to punctuated moments of terrors, not the years spent on cruise control” –by Morgan Housel in his book ‘The Psychology of Money’.

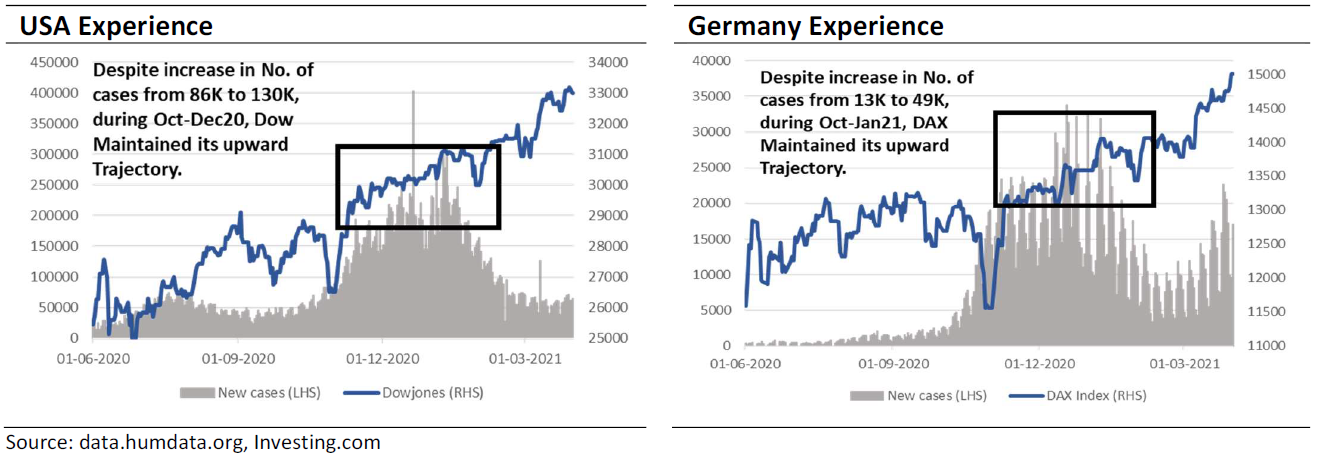

We are at an uncertain juncture of the market. Investors are grappling with interpreting the impact of Covid second wave on the economy and its subsequent impact on the market. Against that backdrop, it is crucial to analyse the world experience of Covid second wave, particularly in the western markets like the US and Europe. The USA witnessed a daily increase in the number of cases from 86000 to 310000 during Oct-Dec20; however, Dow Jones Index continued its upward trajectory. Similarly, Germany witnessed an increase in the daily number of cases from 13000 to 49000 from Oct 2020 to Jan 2021, but DAX Equity Index continued to register strong gains.

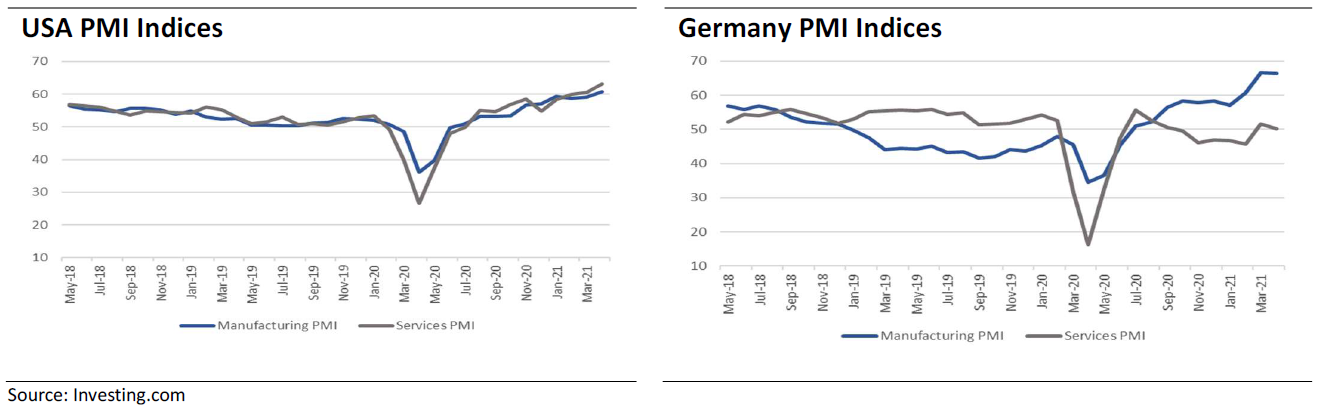

The important reasons for such a strong equity market performance are 1. Global central bankers and governments continued to support the economy; 2. Manufacturing PMI Indices continued their strong recovery – surpassing pre Covid levels while services Index was adversely impacted and 3. The hope of faster vaccination roll out.

Back at home, the situation is not much different. Unlike in Mar2020, during Covid second wave, the lockdowns restrictions are much more balanced – the movement of goods is not restricted, lockdowns are managed by each state depending upon its severity, unlike national lockdown and, most importantly, the strong start of vaccination drive.

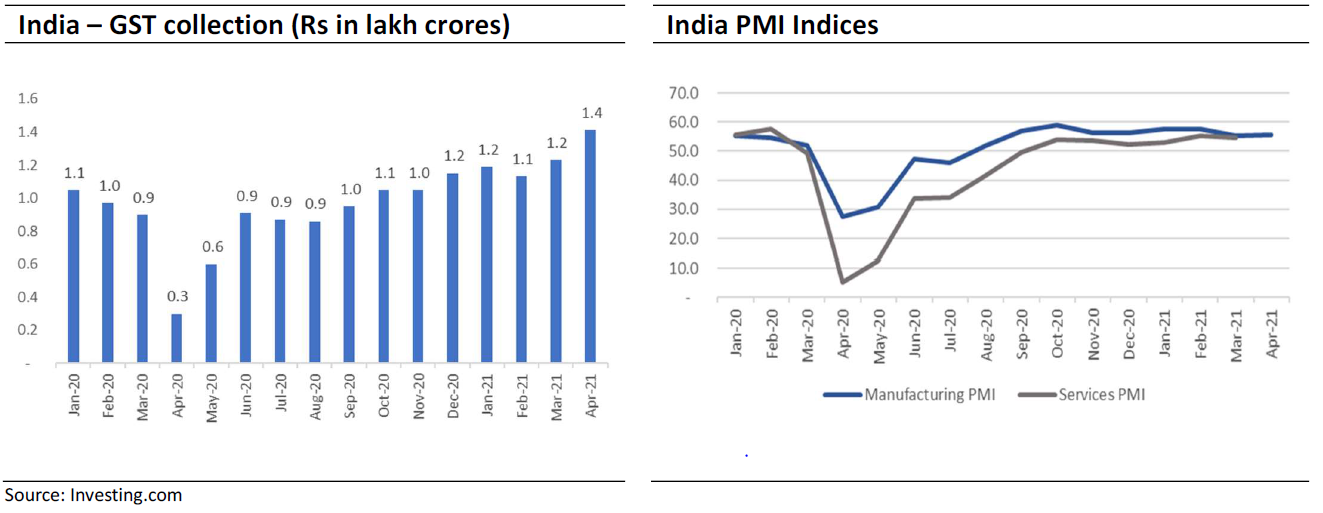

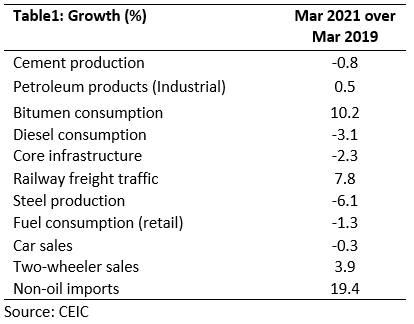

A powerful economic start is already underway. While Covid second wave might have delayed economic recovery, one should not underestimate the sharp recovery witnessed post first Covid wave during the Oct-Mar period. Most corporates were pleasantly surprised by the V-shaped recovery, and many of them faced a stock-out situation. Economic indicators, like cement production, industrial petroleum production, railway freight traffic, non-oil imports registered flat to positive growth over March 2019 – implying normalcy in the economy (since Mar 2020 had seven days of national lockdown, we have compared Mar 2021 numbers against Mar 2019 numbers). For April 2021, the numbers so far suggests limited impact on economy – GST collections have crossed Rs 145000 crs for month of April 2021 – highest in the history. India PMI – manufacturing indices also at its pre-Covid levels.

Investment strategy and Market outlook:

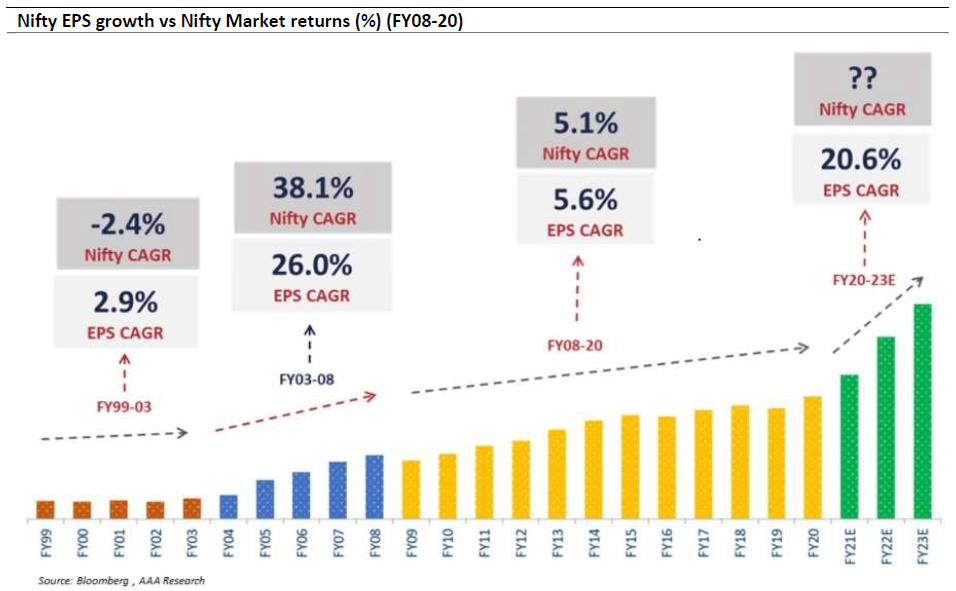

Undoubtedly, Covid second wave will lead to some downgrade in street earnings estimate for FY22; but we believe that one should not focus too much on the near term and instead focus on underlying transformation of the Indian economy. After muted corporate earnings growth for FY08-20; we expect corporate earnings growth to bounce back strongly over FY21-23. As the equity market is mirror of earnings growth, strong earnings growth and improvement in ROE will lead to strong equity returns. We may see bouts of volatility due to Fed’s policy stance and state-wide Covid daily cases headlines, but we advocate to stay invested and looking through any turbulence as our ‘powerful economic start’.

Key Risks: National lockdown, severe Covid third wave, slower vaccination drive.

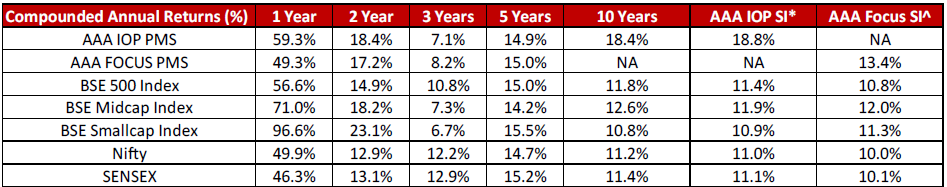

AAA PMS Performance